标签:execution des mon trove src ali read and front

this lesson => Buffet said two things

=> (1) investor skill

=> (2) breadth / the number of investments

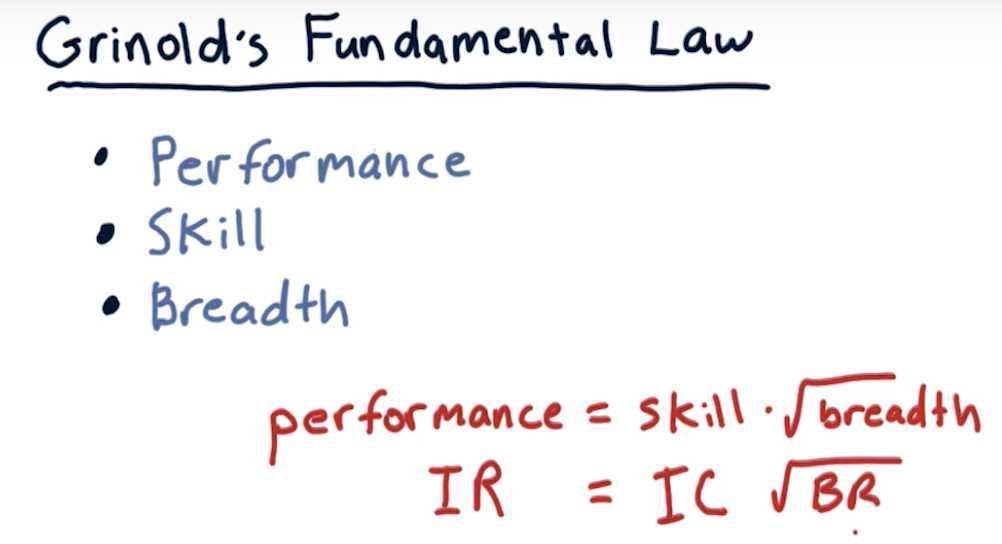

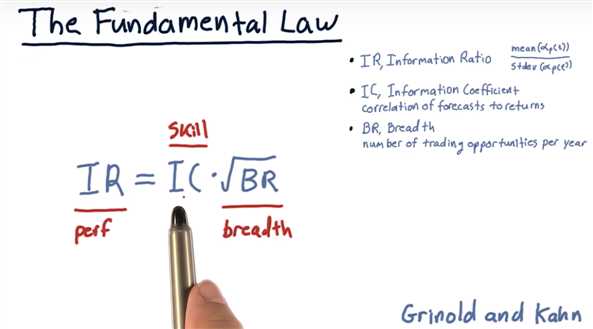

Grinold‘s Fundamental Law

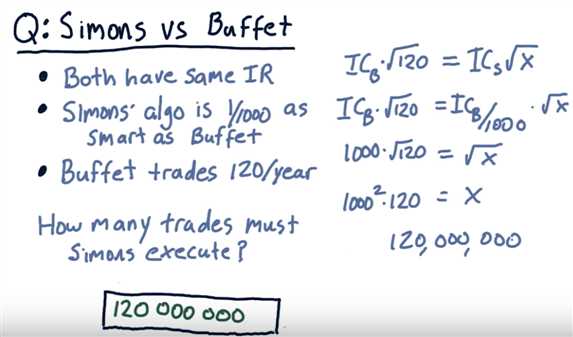

breadth => more opportunities to applying that skill => eg. how many stocks you invest in

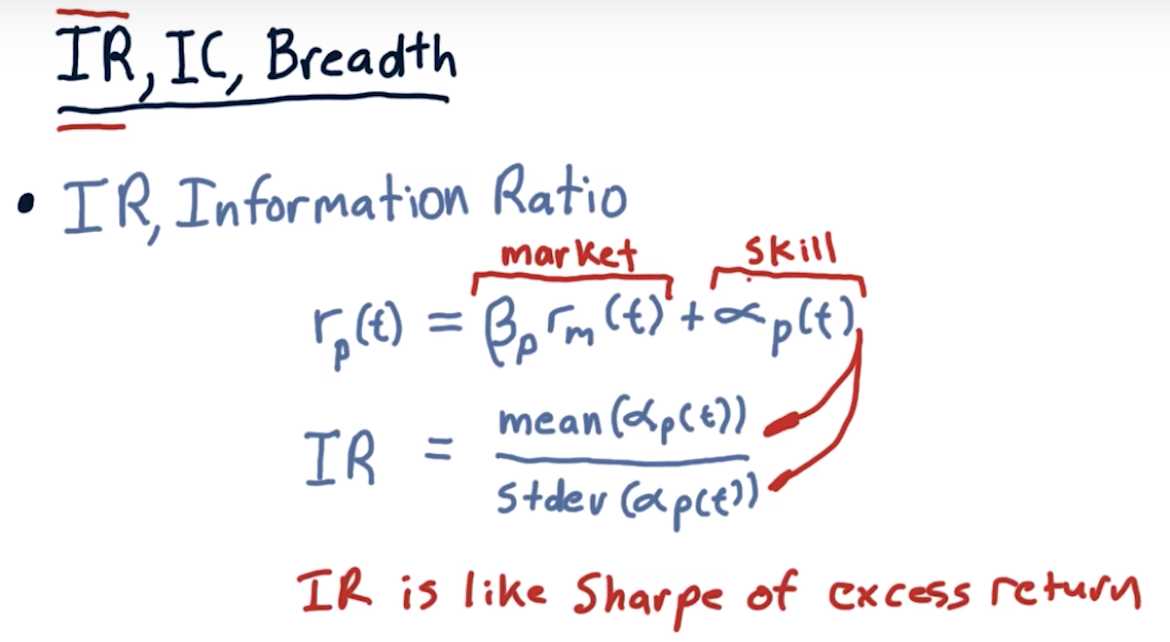

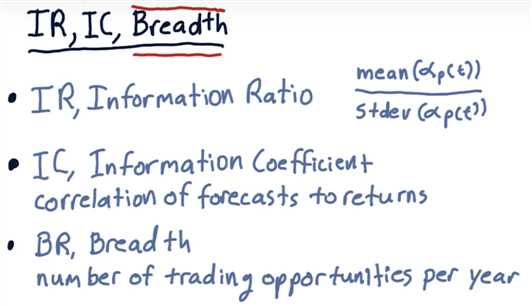

IC => information coefficient

BR => breadth / how many trading opportunities we have

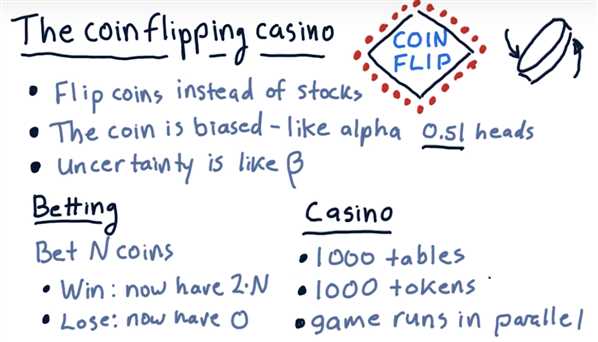

The Coin Flipping Casino

Which bet is better?

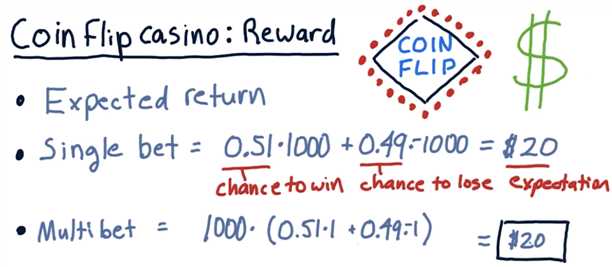

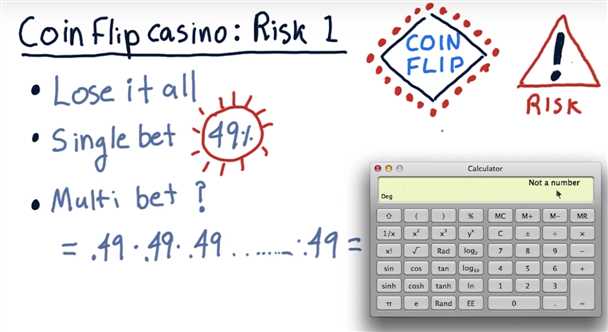

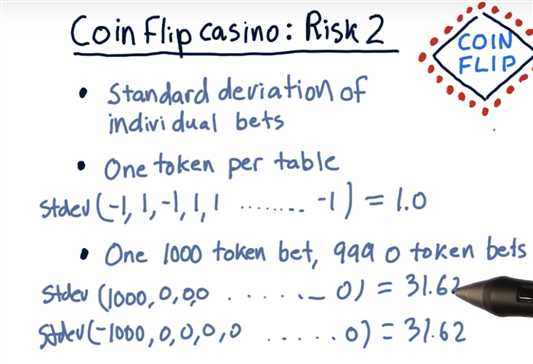

Coin-Flip Casino: Risk

Coin-Flip Casino: Reward/Risk

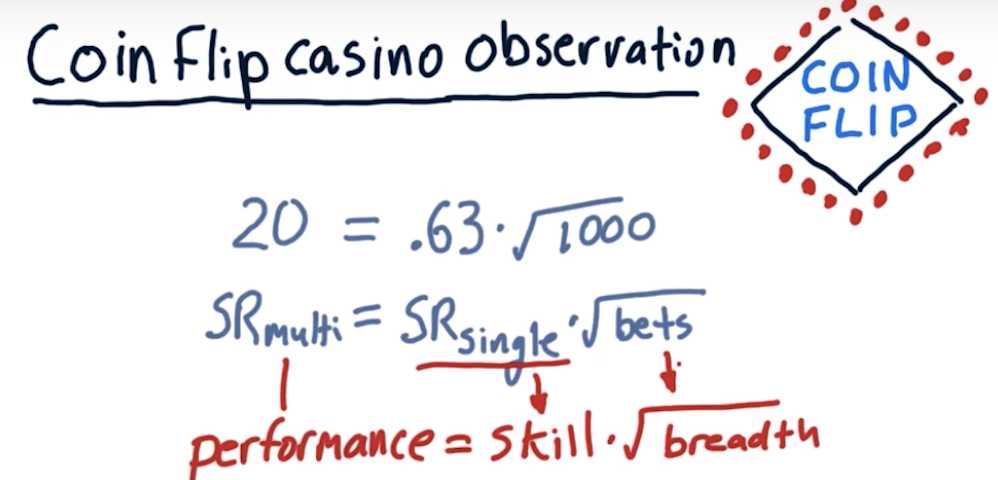

Coin-Flip Casino: Observations

Coin-Flip Casino: Lessons

(1) higher alpha generates a higher sharpe ratio

(2) more execution opportunities provides a higher sharpe ratio

(3) sharpe ratio grows as the square root of breadth

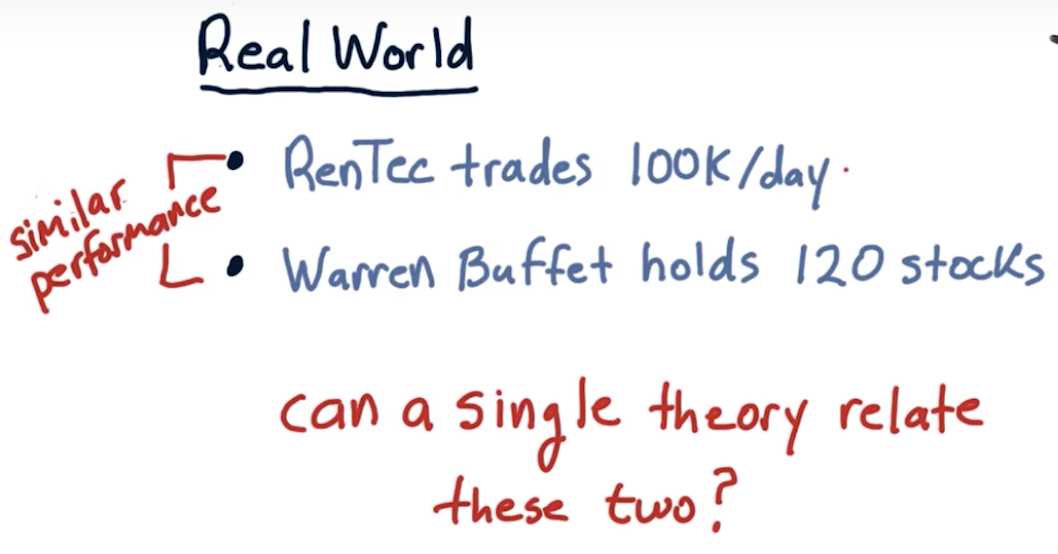

Back to the real world

IR, IC and breadth

The Fundamental Law

skill is harder to be increased than breadth

Skill => introverted

Breadth => extroverted

Simons vs. Buffet

What is risk?

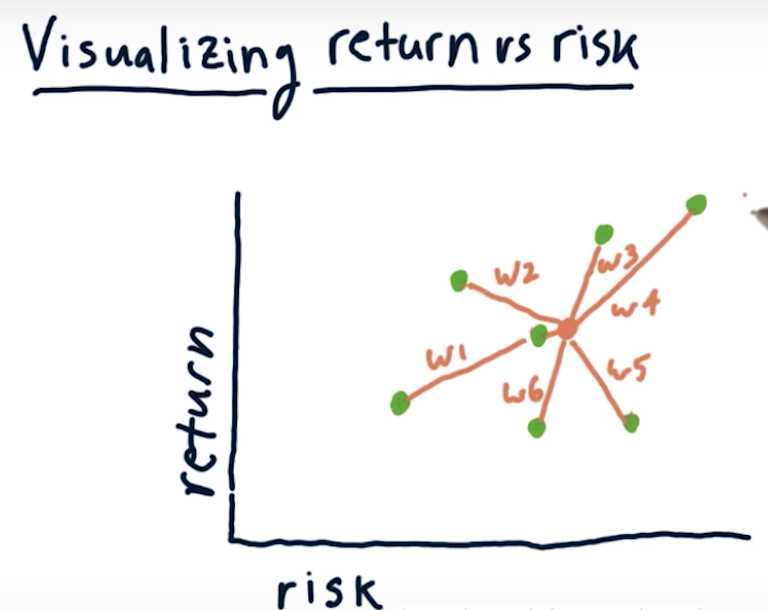

Visualizing return vs risk

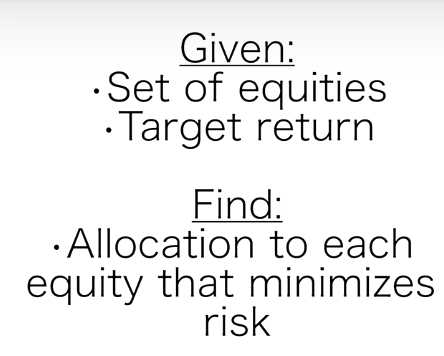

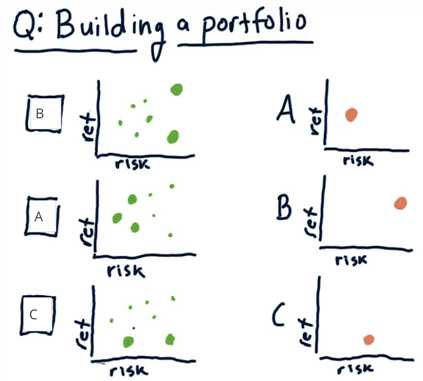

Building a portfolio

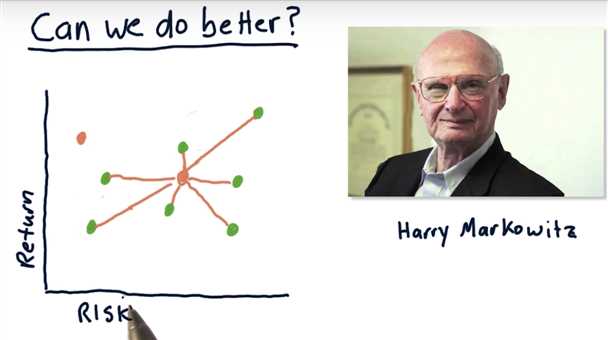

Can we do better?

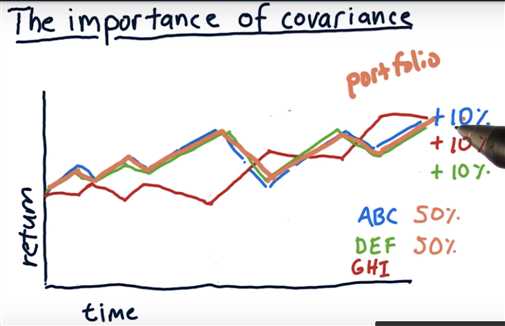

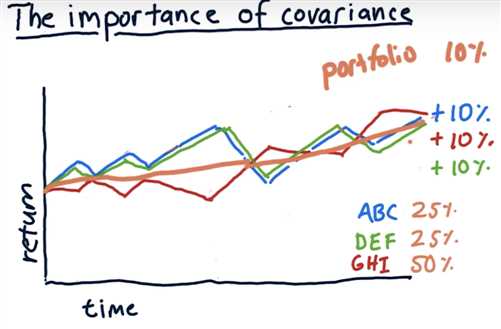

Harry discovered the relationship between stocks in terms of covariance

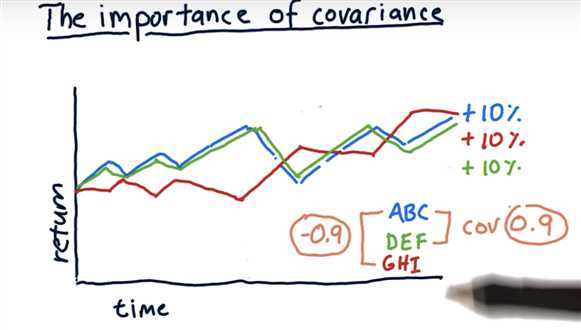

resulting of the portfolio is not just a blend of the various risks

right stocks picking => outliers

Why covariance matters

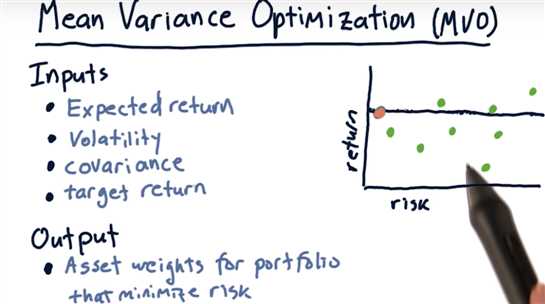

Mean Variance Optimization

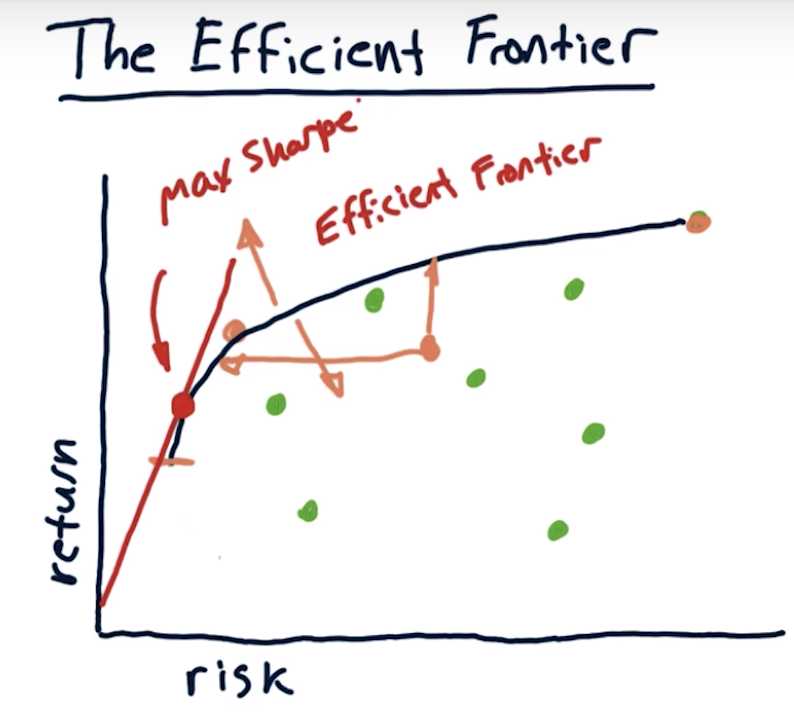

The efficient frontier

标签:execution des mon trove src ali read and front

原文地址:https://www.cnblogs.com/ecoflex/p/10977417.html