标签:int strong procedure iter 5* bit rds medical ima

Social insurance recently has more attention since there are more people having troubles when applying for work permit extensions. Many foreigners in the last few months have been telling us about getting stuck on this step of their work permit extensions. This article will try to help that.

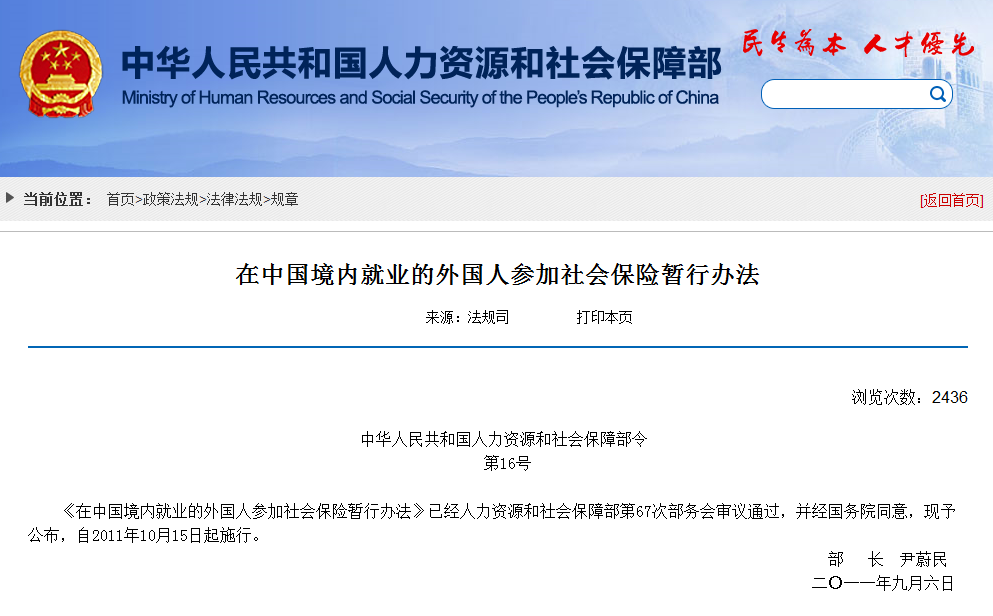

The official document said yes!

Ministry of Human Resources and Social Security of the People‘s Republic of China in 2011 released official documents and procedures for foreigners buying social insurance. It clarified that foreigners who work in China shall buy social insurance as locals. As the system becomes more regulated and standardized, now it can be easier for the government to check its status.

Official documents from Ministry of Human Resources and Social Security of the People‘s Republic of China.

No official document has been released until now!

Until now, no documents from government released that foreigners getting work permit extension need the record of buying social insurance.

However, some applicants in Guangzhou were getting an error when submitting the application for Chinese work permit, where the system of State Administration of Foreign Experts Affairs shows they did not submit the record of paying social insurance.

You can never understand what is happening there, policies ongoing change daily between cities, especially during the period of certain national big events. Here, we collected some of the most frequently asked questions, it may help you understand more about social insurance in China and make your own decision to buy or not.

What is Chinese social insurance?

What benefits can I get from Chinese social insurance?

What consequence will I face I don’t pay for social insurance?

How much do I need to pay for Chinese social insurance?

Can I get back my money from social insurance when I leave China? And how much can I take back?

Important! All Companies Are Requested to Buy Social Insurance

Wow! So Much I Can Get from Social Insurance When Leaving China

It‘s a bit complex when it comes to how much you should pay for social insurance. The infographic below is the latest base pay standards in Guangzhou. If your income is within the bracket, then you need to pay that percentage amount on your income, for each category.

According to the latest data, 2906 and 4455 are two references as the minimum base pay for pension, medical and unemployment insurance in Guangzhou.

If choosing the minimum base pay, you just need to pay:

2,906*8%+4,455*2%+2,906*0.2% = 327.39RMB

But we suggest using the actual salary as the base pay, the amount of paying social insurance directly reflects how much you earn. The Chinese government calculates your salary in China as a big part of the criteria for giving work permits, you should have a convincing salary to show your value.

So, If your monthly salary is 10,000RMB before taxation, paying social insurance based on actual salary, here is the equation:

10,000*(8%+2%+0.2%) = 1020RMB

HiTouch Consulting, established in 2009, is dedicated to providing professional business and legal solutions to international and domestic companies.

Complete Explanation of Social Insurance on Work Permits!

标签:int strong procedure iter 5* bit rds medical ima

原文地址:http://www.cnblogs.com/hitouch/p/7742780.html