标签:contact request ase nat shared related why please tin

As we mentioned last week, the Chinese government requires all company and individuals to buy social insurance, including foreigners. Why are foreigners required to buy social insurance in China?

?

Yes, if you work in China, you are required to buy social insurance. After the reform of "five certificates in one", systems between governments are connected.

In the long term, your social insurance record in Social Security Bureau will be submitted online shared with local Taxation Bureau, Foreign Experts Bureau, Immigration office and other government organizations.

It means in the future, the record of buying social insurance may be taken into the consideration of acquiring a work permit extension from Foreign Experts Bureau.

Seeing a doctor in China is not cheap, but the medical insurance of the social pooling is affordable to fund you the majority of medical fees.

Maternity insurance is NOT just to apply for reimbursement of giving a baby or have a body check before the childbirth.

You can get a big amount of maternity insurance after giving a baby. That amount of money depends on a systematical calculation, check the article below.

With social insurance, you are also entitled to buy property in China, like houses, vehicles; send your children to public school; get a pension after retirement or acquire alms when losing a job...etc.

Only one document needed

For a foreigner, you can buy social insurance with a work permit.

How much I need to pay?

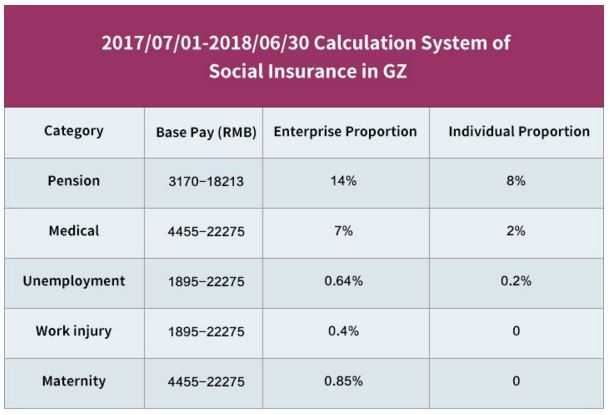

Social insurance is funded through social pooling, formed from payments made by the employer, and employee, to varying base pay.

See the picture below, the base pay is a standard given by the government to make the calculation.

The calculations below are only for a reference

If your monthly salary is 10,000RMB before taxation, you need to pay:

10,000*(8%+2%+0.2%)=1020RMB

Correspondently, your company needs to pay:

10,000*(14%+7%+0.64%+0.4%+0.85%)=2289RMB

For more details on buying social insurance, please feel free to contact us.

You may also want to know this related article:

Important! All Companies Are Requested to Buy Social Insuranc

HiTouch Consulting, established in 2009, is dedicated to providing professional business and legal solutions to international and domestic companies.Guangzhou open Hong Kong bank account,can consult HiTouch.

Everything You Need to Know about Chinese Social Insurance

标签:contact request ase nat shared related why please tin

原文地址:http://www.cnblogs.com/hitouch/p/7793841.html