标签:des style blog http color io os ar for

1 \documentclass[12pt,a4paper,titlepage]{article} 2 3 \setlength{\textheight}{22.5true cm} 4 \setlength{\textwidth}{16.5true cm} \oddsidemargin -1pt 5 \evensidemargin -1pt \topmargin -1cm \setlength{\parskip}{0pt} 6 7 \usepackage{amsmath} 8 \usepackage{latexsym} 9 \usepackage{amssymb} 10 \usepackage{amstext} 11 \usepackage{fancyhdr} 12 \usepackage{array} 13 \usepackage{graphicx,picinpar,epsf} 14 15 \usepackage{color} 16 \usepackage{titlesec} 17 \usepackage{lastpage} 18 \graphicspath{{./figure/}} 19 20 \begin{document} 21 22 \setlength{\parindent}{0pt} 23 \setlength{\parskip}{1.5ex plus 0.5ex 24 minus 0.2ex} 25 \title{The Coming Oil Crisis} 26 \author{Team \# 321} 27 \date{February 7, 2005} 28 29 \maketitle 30 31 \fancyhead{} \pagestyle{fancy} \lhead{Team \#321} 32 \rhead{Page 33 \thepage\ of \pageref{LastPage}} \renewcommand{\headrulewidth}{0pt} 34 35 \begin{abstract} 36 37 \setlength{\parindent}{0pt} 38 \setlength{\parskip}{1.5ex plus 0.5ex 39 minus 0.2ex} 40 41 \noindent In this paper, we study oil, a typical vital 42 nonrenewable resource, to model the depletion of nonrenewable 43 resources. 44 45 First, based on the demand-supply theory, we establish a 46 differential equation system including oil demand $D(t)$, oil 47 supply $S(t)$, and oil price $P(t)$, and thereby get the explicit 48 formulas of the three variables, respectively. Considering the 49 intrinsic law of nonrenewable resources, i.e. the value of 50 nonrenewable resources increases with the elapse of time, we 51 suitably modify the above-mentioned model to reflect the worldwide 52 oil demand dependent on time. The modified demand function $D(t)$ 53 can be written as follows: 54 55 \[ D(t)=a_{1}+a_{2}\cos(a_{3}t+a_{4})+a_{5}\exp(a_{6}t). 56 \] 57 58 Using the modified model to fit the worldwide oil demand data from 59 1970 to 2003, we find the goodness of fit is very satisfactory. 60 From this model and available related data, we conclude that the 61 worldwide endowment of oil will be used up in 2032 without any 62 effective measure. Then we take the economic, demographic, 63 political, and environmental factors into account, and discuss the 64 influences of these factors on oil demand. 65 66 To meet the needs of contemporary human beings without 67 compromising the capacity of future generations to meet their 68 needs, we establish the criterion of the rational oil allocation 69 between generations, and construct the optimal oil allocation 70 model under this criterion. To explain it clearly, an illustration 71 and the corresponding optimal oil allocation scheme are provided. 72 As for the disasters accompanied by oil exploitation, we provide a 73 strategy for oil exploitation to reduce the possibility of 74 disasters in short term. In the end, according to marginal utility 75 replacement rules, we also study the trade-off between oil and its 76 alternatives. 77 78 Owing to the fact that the model building in this paper is on 79 basis of demand-supply theory and intrinsic law of nonrenewable 80 resources, our model can be applied to general nonrenewable 81 resources. 82 83 \end{abstract} 84 85 \newpage 86 87 \tableofcontents 88 89 \newpage 90 91 92 \section{Introduction} 93 Natural resources can be classified into two categories: 94 nonrenewable resources and renewable resources. Natural resources 95 such as oil, copper or iron that once used cannot renew itself, at 96 least not in this geological age and are called nonrenewable 97 resources. Other resources such as fish or trees can renew 98 themselves if not overused and so are called renewable resources. 99 100 In today‘s world, human produce, distribute and consume large 101 quantities of oil. Oil is used as a major power source to fuel our 102 factories and various modes of transportation, and in many 103 everyday-products, such as plastics, nylon, paints, tires, 104 cosmetics, and detergents. 105 106 With the development of science and technology, nowadays we can 107 produce more products than we did, but at the cost of consuming a 108 huge amount of oil. Whenever we ponder the future of the human 109 enterprise, questions about oil come up. The Earth‘s oil reserves 110 are finite, so we must choose how best to use it. 111 112 113 \section{Problem restatement} 114 This problem wants us to select a vital nonrenewable resource, and 115 find out appropriate worldwide historical data on its endowment, 116 discovery, annual consumption, and price. 117 118 \textbf{Task 1} asks us to use the data we obtain to design a 119 model to predict the depletion or degradation of the commodity 120 over a long horizon. 121 122 \textbf{Task 2} requires us to modify our model to account for 123 future economic, demographic, political and environmental factors, 124 and explain its limitation. 125 126 \textbf{Task 3} wants us to create a practical policy which 127 sustains the usage of the resource for a long period of time while 128 avoiding rapid exhaustion of the resource. 129 130 \textbf{Task 4} asks us to develop a "security" policy to protect 131 the resource against misuse. 132 133 \textbf{Task 5} requires us to develop policies to control any 134 short-or long-term "environmental effects". 135 136 \textbf{Task 6} wants us to compare this resource with any other 137 alternatives for its purpose, and develop a research policy to 138 advance these alternatives. 139 140 \section{Task 1 Modeling the Depletion of Oil} 141 Under the following assumptions, we will have a rather pessimistic 142 situation, where no restriction is made to protect oil, and 143 obviously oil will be in the state of total exhaustion in the 144 fastest way. 145 146 \subsection{Assumptions:} 147 148 \begin{enumerate} 149 \item Oil refinement capacity is enough. 150 \item All the undiscovered oil is available when necessary. 151 \end{enumerate} 152 153 In other words, when there is a demand, there is a supply, until 154 the day all the oil on the earth is completely used up. 155 156 157 \subsection{Notations:} 158 159 160 \ \ \ $U(t)$: Oil undiscovered at year $t$ . 161 162 \ \ \ $R(t)$: Oil discovered but has not been used (reserves) at 163 year $t$. 164 165 \ \ \ $D(t)$: Worldwide oil demand at year $t$.(thousand barrels) 166 167 \ \ \ $S(t)$ : Worldwide oil supply at year $t$. 168 169 \ \ \ $p(t)$: Oil price at year $t$. 170 171 \ \ \ $p_{0}$: The equilibrium price of oil. 172 173 174 175 \subsection{Modeling:} 176 From the above definition of notations, we know $U(t)+R(t)$ 177 denotes the total remaining oil on the earth at year $t$, and 178 $\sum^n_{i=t}D(i)$ is the total demand from year $t$ to year $n$. 179 180 181 \begin{equation} 182 \centering \sum^n_{i=t}D(i)\leq U(t)+R(t)<\sum^{n+1}_{i=t}D(i) 183 \end{equation} 184 185 186 Based on the above inequalities we can say that oil will be 187 depleted between year $n$ to year $n+1$. 188 189 The data we can find are: 190 191 \begin{enumerate} 192 193 \item The estimation of undiscovered oil worldwide in 1997 is 194 180 billion barrels, that is to say, $U(1997)=180$ (billion 195 barrels). (see [4]) 196 197 \item The worldwide oil reserve in 1997 is 1018.5 billion barrels, 198 viz. $R(1997)=1018.5$ (billion barrels). (see [3]) 199 200 \item The worldwide oil demands from 1980 to 201 2003, $D(i)(i=1980,\cdots,2003)$ are shown in the table below. 202 (see [3]) 203 204 \end{enumerate} 205 206 \makeatletter 207 \def\hlinewd#1{% 208 \noalign{\ifnum0=`}\fi\hrule \@height #1 \futurelet 209 \reserved@a\@xhline} 210 \makeatother 211 212 \begin{table}[!htb] 213 \centering \caption{World-wide oil demand, $1970 \backsim 2003$ 214 (thousands of barrels/day)} 215 \begin{tabular}{ll|ll|ll|ll} 216 \hlinewd{1pt} 217 1970 & 46,808 & 1980 & 63,108 & 1990 & 66,443 & 2000 & 76,954 \ 218 1971 & 49,416 & 1981 & 60,944 & 1991 & 67,061 & 2001 & 78,105 \ 219 1972 & 53,094 & 1982 & 59,543 & 1992 & 67,273 & 2002 & 78,439 \ 220 1973 & 57,237 & 1983 & 58,779 & 1993 & 67,372 & 2003 & 79,813 \ 221 1974 & 56,677 & 1984 & 59,822 & 1994 & 68,679 & & \ 222 1975 & 56,198 & 1985 & 60,087 & 1995 & 69,955 & & \ 223 1976 & 59,673 & 1986 & 61,825 & 1996 & 71,522 & & \ 224 1977 & 61,826 & 1987 & 63,104 & 1997 & 73,292 & & \ 225 1978 & 64,158 & 1988 & 64,963 & 1998 & 73,932 & & \ 226 1979 & 65,220 & 1989 & 66,092 & 1999 & 75,826 & & \ 227 \hlinewd{1pt} 228 \end{tabular} 229 230 \end{table} 231 232 If we have some information of future oil demand, namely $D(i) 233 (i=2004,2005,\ldots)$, then (1) changes to 234 235 \[ 236 \sum^{n}_{i=1997}D(i)\leq U(1997)+R(1997)<\sum^{n+1}_{i=1997}D(i). 237 \] 238 239 Then $n$, the year when oil is used up it can be easily 240 calculated. 241 242 In order to predict future oil demand, we now consider the 243 following ordinary differential equation system according to 244 ‘supply-demand‘ principles: 245 246 $$ 247 \begin{cases} 248 \dfrac{d S}{dt}=a\tilde{P}& \quad \quad(1.1)\\\ 249 \dfrac{d \tilde{P}}{dt}=-b(S-D)& \quad\quad(1.2)\\\ 250 \dfrac{d D}{dt}=-c\tilde{P}& \quad \quad(1.3) 251 \end{cases} 252 $$ 253 254 255 256 where $\tilde{P}=P(t)-P_{0}$ , and $a>0,b>0,c>0$(constant). 257 258 Now we give some explanations of the system. Eq.(1.1) means that 259 if oil piece is greater than its equilibrium price, the output 260 will increase accordingly, and vice versa. Eq.(1.2) shows that if 261 oil supply exceeds its demand, the price will decline. Eq.(1.2) 262 indicates when oil price is up or down, the demand of oil will 263 expand or shrink correspondingly. 264 265 After careful calculation, we get the solution of the above 266 ordinary differential equation system: 267 268 $$\begin{cases} 269 \tilde{P}(t)=\sqrt{\tilde{c_1}^2+\tilde{c_2}^2}\times\sin[\sqrt{(ba+c)}\times 270 t+\varphi]& \ \ \ \ \ \ \ \ \ \ \ \ \ \ \ \ \ \ 271 \ \ \ \ \ \ \ \ \ \ \ (2.1)\\ \ 272 S(t)=S_0-\frac{a\sqrt{\tilde{c_1}^2+\tilde{c_2}^2}\times\cos[\sqrt{b(a+c)}\times 273 t+\varphi]}{\sqrt{b(a+c)}}& 274 \ \ \ \ \ \ \ \ \ \ \ \ \ \ \ \ \ \ \ \ \ \ \ \ \ \ \ \ \ \ (2.2)\\ \ 275 D(t)=D_0+\frac{c\sqrt{\tilde{c_1}^2+\tilde{c_2}^2}}{\sqrt{b(a+c)}}\cos[\sqrt{b(a+c)}\times 276 t+\varphi]& \ \ \ \ \ \ \ \ \ \ \ \ \ \ \ \ \ \ \ \ 277 \ \ \ \ \ \ \ \ \ (2.3) 278 \end{cases} 279 $$ 280 where $\varphi=\arctan\frac{\tilde{c_{1}}}{\tilde{c_{2}}}$ , and 281 $S_{0},D_{0},\tilde{c_{1}},\tilde{c_{2}}$ are parameters to be 282 determined. 283 284 285 Here, we place our interests on Eq.(2.3). It implies that oil 286 demand is in a periodical form. However, with the time passing by, 287 the population on the earth is expanding in an exponential way, 288 and the demand of oil is accordingly increasing in a similar way. 289 Therefore we should modify Eq.(2.3) to reflect the intrinsic 290 increasing tendency. We consider adding a term of exponential 291 function $k_{1}\exp(k_{2}(t-t_{0}))$($k_{1},k_{2},t_{0}$are 292 constants) to the right side of Eq.(2.3). And after some 293 simplification, we can easily get the following equation: 294 295 296 \begin{equation} 297 D(t)=a_{1}+a_{2}\cos(a_{3}t+a_{4})+a_{5}\exp(a_{6}t) 298 \end{equation} 299 300 Using Eq.(2) to fit the data in Table 1, we can get the fitting 301 curve of Figure 1, from which we can easily find the goodness of 302 fit is quite satisfactory. And the function we get after fitting 303 is: 304 305 \[ 306 D(t)=365*(31950+556.7\cos(1.605t-3159.659)+(1.239*10^{-16})*\exp(0.02366t)) 307 \] 308 309 \begin{figure}[!htb] \centering 310 \includegraphics[width=0.7\textwidth]{fig01.eps} 311 \caption{The fitting curve by Eq.(2)} 312 \end{figure} 313 314 315 316 Noticing that with the passing of time, the third term 317 ($a_5\exp(a_6t)$) on the right side of Eq.(2) will play a more 318 important role and the second term$(a_{2}\cos(a_{3}t+a_{4}))$ can 319 be neglected, thus for the sake of convenience, we reduce Eq.(2) 320 to: 321 322 323 \begin{equation} 324 D(t)=a_{1}+a_{5}\exp(a_{6}t) 325 \end{equation} 326 327 Hence we choose exponential fitting to predict future demand, and 328 for the purpose of comparison, we also choose linear fitting and a 329 invariable demand case in which future demand is assumed the same 330 as that of 2003. The data for fitting is world-wide oil demand 331 $D(i)(i=1970,\ldots,2003)$ in Table 1 , and the fitting results 332 are given as follows: 333 334 Exponential fitting:\[ 335 D(t)=365*(29820+2.265*10^{-15}*\exp(0.02223*t)) (t\geq 2004) 336 \] 337 338 Linear fitting:\[ D(t)=365*(771.2*t+(-1.467e+006)) (t\geq 2004) 339 \] 340 341 The predicted demand is shown in Figure 2. (For convenience, 342 annual demand is in the form of average daily demand.) 343 344 \begin{figure}[!htb] \centering 345 \includegraphics[width=0.7\textwidth]{fig02.eps} 346 \caption{Estimation of future oil demand} 347 \end{figure} 348 349 \textit{Remark: With the increase of oil demand, its price will 350 accordingly rise. As is shown by the broken lines in figure 2, 351 this will lead to the decline of oil demand, and we will discuss 352 this phenomenon in detail later.} 353 354 355 \subsection{Sensitivity Analysis:} 356 357 Based on the above assumption,$U(t)$ is the undiscovered oil on 358 earth at year $t$, so it is difficult to get a precise value. What 359 we can acquire is merely an estimation, which may contain a 360 certain degree of deviation. We now investigate whether the 361 deviation will bring about a serious distortion on the 362 determination on $n$. 363 364 We give $U(t)(t=1997)$ a fluctuation of $\pm10\%$, and study the 365 corresponding change of $n$. The conclusion is shown in Table 2. 366 367 From table 2, we can learn that the fluctuation of $U(t)$ does not 368 have a strong influence on the estimated year of oil‘s exhaustion. 369 370 \begin{table} 371 \centering \caption{the relationship between the fluctuation of 372 $U(t)$ and the year of oil exhaustion} 373 \begin{tabular}{|l|l|lll|lll|lll|} 374 \hlinewd{1pt} 375 \multicolumn{2}{|c|}{The year of oil exhaustion($n$)} & \multicolumn{9}{c|}{Fluctuation of $u(t)$(t=2000)} \ 376 \hlinewd{1pt} 377 \multicolumn{1}{|c|}{} & \multicolumn{1}{c|}{Exponential} & \multicolumn{1}{c}{} & \multicolumn{1}{c}{-10\%} & \multicolumn{1}{c|}{} & \multicolumn{1}{c}{} & \multicolumn{1}{c}{0\%} & \multicolumn{1}{c|}{} & \multicolumn{1}{c}{} & \multicolumn{1}{c}{+10\%} & \multicolumn{1}{c|}{} \ 378 \cline{2-11} 379 \multicolumn{1}{|c|}{The way of} & \multicolumn{1}{c|}{Linear} & \multicolumn{1}{c}{} & 2032 & & \multicolumn{1}{c}{} & \multicolumn{1}{c}{2032} & \multicolumn{1}{c|}{} & \multicolumn{1}{c}{} & \multicolumn{1}{c}{2032} & \multicolumn{1}{c|}{} \ 380 \cline{2-11} 381 \multicolumn{1}{|c|}{fitting} & \multicolumn{1}{c|}{Invariable} & \multicolumn{1}{c}{} & \multicolumn{1}{c}{2033} & \multicolumn{1}{c|}{} & \multicolumn{1}{c}{} & \multicolumn{1}{c}{2033} & \multicolumn{1}{c|}{} & \multicolumn{1}{c}{} & \multicolumn{1}{c}{2034} & \multicolumn{1}{c|}{} \ 382 \cline{2-11} 383 \multicolumn{1}{|c|}{} & \multicolumn{1}{c|}{demand case} & \multicolumn{1}{c}{} & \multicolumn{1}{c}{2036} & \multicolumn{1}{c|}{} & \multicolumn{1}{c}{} & \multicolumn{1}{c}{2037} & \multicolumn{1}{c|}{} & \multicolumn{1}{c}{} & \multicolumn{1}{c}{2037} & \multicolumn{1}{c|}{} \ 384 \hlinewd{1pt} 385 \end{tabular} 386 \end{table} 387 388 389 \section{Task 2 The Influence of Economic, Demographic, Political and Environmental Factors on the Oil} 390 391 \subsection{Assumptions} 392 \begin{enumerate} 393 \item We assume that the annual demand of oil could reflect the annual consumption of oil. 394 395 \item When we consider the effect of one factor, the other factors 396 are neglected, in other words, we do not take the interaction of 397 arbitrary two different factors into account. 398 399 \item When considering the future consumption of oil, we ignore the 400 intrinsic fluctuation, because its influence is really small. That 401 means we only consider the tendency of the future tendency. 402 \end{enumerate} 403 404 405 In task 1, we‘ve assumed that oil demand is in an exponential 406 form, but in reality, many factors such as economy, population, 407 politics and environment, will influence oil consumption. Thus, in 408 the following discussion, we modify the model provided in Task 1 409 to include the above-mentioned factors and thereby make our 410 results more approximate to the reality. 411 412 413 \subsection{The Influence of Economic Factors} 414 415 We use GDP as the measure of economy. First we investigate the 416 relationship between demand and supply. Based on the data of 417 worldwide oil demand and supply between 1970 and 2003, we perform 418 a correlation analysis between oil demand and oil supply, and get 419 the correlation coefficient $r= 0.9911$. Therefore, we justifiably 420 deem that demand is almost linearly dependent on supply. So when 421 we consider the influence of oil on demand, caused by economic, we 422 take the demand as a dependent variable. And the data we obtain 423 about the recent world total GDP is shown in Table 3, while the 424 data about the total world oil consumption in recent years is 425 shown in Table 4. 426 427 \begin{table}[!htb] 428 \centering \caption{Recent World Total GDP(\$ 108),1995-2003} 429 \begin{tabular}{lllllllll} 430 \hlinewd{1pt} 431 \multicolumn{1}{c}{1995} & \multicolumn{1}{c}{1996} & \multicolumn{1}{c}{1997} & \multicolumn{1}{c}{1998} & \multicolumn{1}{c}{1999} & \multicolumn{1}{c}{2000} & \multicolumn{1}{c}{2001} & \multicolumn{1}{c}{2002} & \multicolumn{1}{c}{2003} \ 432 \hline 433 \multicolumn{1}{c}{27.134} & \multicolumn{1}{c}{28.247} & \multicolumn{1}{c}{29.433} & \multicolumn{1}{c}{30.257} & \multicolumn{1}{c}{31.377} & \multicolumn{1}{c}{32.85} & \multicolumn{1}{c}{33.64} & \multicolumn{1}{c}{34.6487} & \multicolumn{1}{c}{36} \ 434 \hlinewd{1pt} 435 \end{tabular} 436 \end{table} 437 438 439 440 \begin{table}[!htb] 441 \centering \caption{Recent Total World Oil Consumption($10^3$ 442 thousands of barrels/day),1995-2003} 443 \begin{tabular}{lllllllll} 444 \hlinewd{1pt} 445 \multicolumn{1}{c}{1995} & \multicolumn{1}{c}{1996} & \multicolumn{1}{c}{1997} & \multicolumn{1}{c}{1998} & \multicolumn{1}{c}{1999} & \multicolumn{1}{c}{2000} & \multicolumn{1}{c}{2001} & \multicolumn{1}{c}{2002} & \multicolumn{1}{c}{2003} \ 446 \hline 447 \multicolumn{1}{c}{69955} & \multicolumn{1}{c}{71522} & \multicolumn{1}{c}{73292} & \multicolumn{1}{c}{73932} & \multicolumn{1}{c}{75826} & \multicolumn{1}{c}{76954} & \multicolumn{1}{c}{78105} & \multicolumn{1}{c}{78439} & \multicolumn{1}{c}{79813} \ 448 \hlinewd{1pt} 449 \end{tabular} 450 \end{table} 451 452 We know from the table that the GDP value and the worldwide oil 453 consumption both increase as time elapses. Hence we make a 454 correlation analysis for these two lists of data, and the 455 correlation coefficient turns out to be 0.9930. That is to say, 456 the GDP value and oil consumption are of strong positive linear 457 dependence. 458 459 In order to find out the intrinsic relationship between them, we 460 make a linear regression for these data. The regression equation 461 is given as follows: 462 463 464 \begin{equation} 465 y=1183\times x+38140 466 \end{equation} 467 468 469 \newenvironment{vardesc}[1]{% 470 \settowidth{\parindent}{#1\ } \makebox[0pt][r]{#1\ }}{} 471 472 \begin{vardesc}{Where}$x$: global GDP value 473 474 $y$: worldwide oil consumption 475 \end{vardesc} 476 477 And \textit{R-square}.(square of regression coefficient) is 478 0.9861. And the further statistical significance test shows that 479 there indeed exists a linear dependence between the global GDP 480 value and worldwide oil consumption. 481 482 Next, using Eq.(4), we can predict the cumulative oil demand as 483 the global GDP grows at the rate of 10\%, 5\%, 3\%, 1\% 484 respectively. For the convenience, we take the year 2001 as the 485 starting point, and we get that the total remaining oil on earth 486 at that time is $1.1178\times 10^{+12}$(barrels). And then we 487 calculate the time of the oil exhaustion under different cases of 488 economic growth. Oil depletion time is shown in the following 489 figure: 490 491 \begin{figure}[!htb] \centering 492 \includegraphics[width=0.7\textwidth]{fig03.eps} 493 \caption{the curves of cumulative consumption under different 494 rates of GDP growth} 495 \end{figure} 496 497 The horizontal line denotes the total remaining oil at year 2001. 498 The x-axis coordinates of the intersection points of the 499 horizontal line and the curves denote oil exhaustion time at the 500 GDP growth rate of 10\%, 5\%, 3\%, 1\% , respectively. 501 502 503 We find that the faster the GDP growth rate is, the larger the oil 504 consumption will be, making the advent of the exhaustion time to 505 come sooner. When the GDP growth rate is 10\%, oil will be 506 depleted at 2020; when the GDP growth rate is 5\%, oil will be 507 used up at 2026; When the GDP growth rate is 3\%, oil will be used 508 out at 2029,and finally, When the GDP growth rate is 1\%, oil will 509 be used out at 2035. 510 511 512 As for a specific nation, its GDP growth rate can be controlled 513 through some economic approaches, so as to delay the advent of oil 514 exhaustion. 515 516 517 518 \subsection{The Demographic Influence on Oil Consumption} 519 520 First, we resort to \emph{\textbf{Logistic}} model to predict the 521 change of world population in years to come. The model is as 522 follows: 523 524 525 \begin{equation} 526 x(t)=\frac{k}{1+(\frac{k}{x_{0}}-1)e^{-(t-t_{0})r}} 527 \end{equation} 528 529 530 531 \begin{vardesc}{Where}$t$: denotes time; 532 533 $t_{0}$: denotes initial time; 534 535 $x_{0}$: denotes the population at initial time; 536 537 $k$: is the environment capacity, namely the maximum number of 538 population the earth can accommodate; 539 540 $r$: is the intrinsic growth rate of population. 541 542 \end{vardesc} 543 544 We use the data of the population in recent decades to fit the 545 above equation, and get the formula of the change of population 546 with time: 547 548 \begin{equation} 549 x(t)=\frac{100}{1+(\frac{100}{44.585}-1)e^{-0.0327\times 550 (t-1980)}} 551 \end{equation} 552 553 Now, using Eq. (6) we can the prediction of future population, 554 which is shown in the following table: 555 556 \begin{table}[!htb] 557 \centering \caption{The population estimated by the 558 \emph{\textbf{Logistic model}}(0.1billion)} 559 \begin{tabular}{lllllllll} 560 \hlinewd{1pt} 561 \multicolumn{1}{c}{1980} & \multicolumn{1}{c}{1990} & \multicolumn{1}{c}{2000} & \multicolumn{1}{c}{2010} & \multicolumn{1}{c}{2020} & \multicolumn{1}{c}{2030} & \multicolumn{1}{c}{3040} & \multicolumn{1}{c}{2050} & \multicolumn{1}{c}{2060} \ 562 \hline 563 \multicolumn{1}{c}{44.585} & \multicolumn{1}{c}{52.736} & \multicolumn{1}{c}{60.744} & \multicolumn{1}{c}{68.212} & \multicolumn{1}{c}{74.849} & \multicolumn{1}{c}{80.495} & \multicolumn{1}{c}{85.126} & \multicolumn{1}{c}{88.811} & \multicolumn{1}{c}{91.560} \ 564 \hlinewd{1pt} 565 \end{tabular} 566 \end{table} 567 568 Similarly, we try to obtain the relationship between oil 569 consumption and total population as we do in the section of 570 studying GDP‘s influence. The correlation coefficient is 0.9877. 571 Obviously, there exists a strong positive linear dependence 572 between oil consumption and total population. Theoretically, the 573 larger the population is, the greater the oil demand will be, 574 which coincides with the above result. 575 576 Naturally, we make a linear regression for oil demand and 577 population, and get the relationship between them as follows: 578 579 \begin{equation} 580 y=1443\times x-11170 581 \end{equation} 582 583 584 585 \begin{vardesc}{Where}$y$: oil consumption;. 586 587 $x$: total population. 588 \end{vardesc} 589 590 591 From (6) we can get the future population, and from (7) we may 592 obtain oil demand in the future. Hence, the time of oil exhaustion 593 can be estimated under such a growth of population. 594 595 \begin{figure}[!htb] \centering 596 \includegraphics[width=0.7\textwidth]{fig04.eps} 597 \caption{the curve of cumulative oil consumption with the growth 598 of population} 599 \end{figure} 600 601 From the above figure we can clearly see that oil will be in the 602 state of exhaustion if population increases in the way of (6). And 603 the intersection point of the horizontal line and the curve is the 604 corresponding exhaustion time under a specific growth rate of 605 population, which is not difficult to estimate. 606 607 608 \subsection{The Political Influence on Oil Consumption} 609 610 Here, we mainly discuss the influences caused by wars. 611 612 613 In Task 1, we have fitted the function of demand dependent on time 614 as follows: 615 616 \[ 617 y(t)=7.95\times 10^{-6}\times e^{0.01149t} 618 \] 619 620 from which we can estimate the oil demand at any given time. Let 621 rate denote the growth rate of oil consumption, thus 622 623 624 \[ 625 rate=\frac{y(t+1)}{y(t)}-1=\frac{7.95\times 10^{-6}\times 626 e^{0.01149(t+1)}}{7.95\times 10^{-6}\times 627 e^{0.01149t}}-1=e^{0.01149}-1 =1.56\% 628 \] 629 630 From the above equation, we find that the annual growth rate of 631 oil consumption remains at the same level of 1.56\% if oil 632 consumption increases in an exponential form, and we call it 633 \emph{\textbf{average growth rate}}. 634 635 Now, we investigate the growth rate of oil consumption during the 636 past decades, and the results are shown in the figure below. 637 638 \begin{figure}[!htb] \centering 639 \includegraphics[width=0.7\textwidth]{fig05.eps} 640 \caption{the curve of oil consumption growth rate and mean growth 641 rate} 642 \end{figure} 643 644 From the figure above, we can obviously see that the growth rate 645 declines sharply in the year 1974 1980 and 1990, which coincides 646 with the outbreak of the fourth Middle East War (1973), the 647 Iran-Iraq War (1980) and the Gulf War (1990). And these three wars 648 all broke out in the Middle East, which is the center of oil 649 production. So the wars strongly impacted the oil price, and 650 consequently impacted the oil demand. 651 652 653 Define 654 \begin{equation} 655 \Delta rate=rate(t)-\overline{rate} 656 \end{equation} 657 658 659 \begin{vardesc}{Where}$rate(t)$: the growth rate of oil consumption at year $t$ 660 661 $\overline{rate}$: the average growth rate of oil consumption 662 \end{vardesc} 663 664 665 666 667 668 So $\Delta rate$ indicates the deviation of oil assumption off its 669 mean level. We calculate the $\Delta rate$ in year 1974, 1980 and 670 1990, respectively, and the three numbers may reflect the affects 671 on oil demand caused by these three wars, respectively. The 672 results are in the table below. 673 674 \begin{table}[!htb] 675 \centering \caption{$\Delta$ rate in year 1974,1980 and 1990} 676 \begin{tabular}{lll} 677 \hlinewd{1pt} 678 \multicolumn{1}{c}{1974} & \multicolumn{1}{c}{1980} & \multicolumn{1}{c}{1990} \ 679 \hline 680 \multicolumn{1}{c}{-0.02533} & \multicolumn{1}{c}{-0.048} & \multicolumn{1}{c}{-0.0103} \ 681 \hlinewd{1pt} 682 \end{tabular} 683 \end{table} 684 685 We reach the conclusion that wars will make the growth rate of oil 686 consumption well bellow its average level. 687 688 As for other political influences, we can use the similar method, 689 and the key is to choose the crucial factor to analysis. 690 691 \subsection{The Environmental Influence on Oil Consumption} 692 693 The use of oil inevitably leads to environment pollution. To 694 protect the environment against excessive pollution, the 695 government would adopt certain measures to limit the use of oil. 696 So the environmental factors will also influence the oil demand. 697 698 699 We take the discharge amount of carbon dioxide generated by oil 700 consumption as the scale to measure the environment pollution, and 701 study the relation between the discharge amount of carbon dioxide 702 and oil consumption. The data of discharge amount of carbon 703 dioxide is shown in the table below. 704 705 \begin{table}[!htb] 706 \centering \caption{World Carbon Dioxide Emissions From the 707 Consumption of Oil (million metric tons of carbon dioxide)} 708 \begin{tabular}{lllllllll} 709 \hlinewd{1pt} 710 \multicolumn{1}{c}{1993} & \multicolumn{1}{c}{1994} & \multicolumn{1}{c}{1995} & \multicolumn{1}{c}{1996} & \multicolumn{1}{c}{1997} & \multicolumn{1}{c}{1998} & \multicolumn{1}{c}{1999} & \multicolumn{1}{c}{2000} & \multicolumn{1}{c}{2001} \ 711 \hline 712 \multicolumn{1}{r}{9220} & \multicolumn{1}{r}{9284} & \multicolumn{1}{r}{9388} & \multicolumn{1}{r}{9586} & \multicolumn{1}{r}{9691} & \multicolumn{1}{r}{9766} & \multicolumn{1}{r}{9939} & \multicolumn{1}{r}{10138} & \multicolumn{1}{r}{10292} \ 713 \hlinewd{1pt} 714 \end{tabular} 715 \end{table} 716 717 First, we also make a correlation analysis for the discharge 718 amount of carbon dioxide and oil consumption, and the correlation 719 coefficient is 0.9937. That is to say, the two variables are of 720 strong positive linear dependence. Then we make a linear 721 regression, and get the relationship between carbon dioxide 722 emission and oil consumption as follows: 723 724 725 \begin{equation} 726 y=10.09\times x-25320 727 \end{equation} 728 729 730 731 \begin{vardesc}{Where}$y$: oil consumption; 732 733 $x$: discharge amount of carbon dioxide caused by oil consumption. 734 \end{vardesc} 735 736 737 738 From Eq $(9)$ we can work out the oil consumption at a controlled 739 annual $\textrm{CO}_{2}$ emission growth rate. We simulate the 740 future oil consumption under different annual $\textrm{CO}_{2}$ 741 emission growth rate of 1\%, 3\%\ldots The corresponding oil 742 exhaustion time is shown in the figure below. 743 744 \begin{figure}[!htb] \centering 745 \includegraphics[width=0.7\textwidth]{fig06.eps} 746 \caption{the curve of cumulative oil consumption under different 747 annual $\textrm{CO}_2$ emission growth rates} 748 \end{figure} 749 750 751 Based on the analysis above, if we want to keep the annual 752 $\textrm{CO}_{2}$ emission growth rate at a given level, we can 753 give the corresponding annual oil consumption, and then fulfill 754 the purpose of protecting the environment. 755 756 \subsection{Limitations} 757 758 The above models are based on the assumption that all the other 759 factors are invariable when modeling for a specific factor. But 760 this cannot be true in reality, because one factor may be 761 interacted with others. Thus, the interactions should be taken 762 into account in further study. 763 764 765 \section{Task 3 The Sustainable Use of Oil} 766 767 In order to prevent the excessive consumption of nonrenewable 768 resource from rapid depletion, and to take into account of our 769 offspring‘s interests, we must develop a policy to control the 770 consumption of nonrenewable resource to give a rational 771 consumption allocation between generations. 772 773 774 \subsection{Assumptions} 775 776 \begin{enumerate} 777 \item We assume that annual demand of oil can truly reflect oil consumption. 778 779 \item Oil consumption in year $t$ can not be far less than that in 780 year $t-1$. 781 782 \item The sustainable use of oil means that we must 783 take the needs of our offspring into account. That is to say, we 784 should provide a rational consumption allocation between 785 generations. 786 787 \item We assume that one generation consists of $n$ years. 788 789 \end{enumerate} 790 791 \subsection{The Criterion of Rational Consumption Allocation of Oil Between Generations.} 792 793 Based on Task 1, we know that $U(t)+R(t)$ denotes the total 794 remaining oil on earth at year $t$, and obviously, it holds that: 795 796 797 \begin{equation} 798 U(t)+R(t)=m_{1}+m_{2} 799 \end{equation} 800 801 \begin{vardesc}{Where}$m_{1}$: the amount of oil for contemporary man; 802 803 $m_{2}$: the amount of oil left for offspring. 804 \end{vardesc} 805 806 In order to give a rational allocation, we define: 807 808 809 \begin{equation} 810 \eta=\frac{m_{2}}{m_{1}}\times 100\% (0\leq \eta \leq 811 \infty) 812 \end{equation} 813 814 $\eta$ is called \textbf{the degree of rational consumption 815 allocation of oil.} 816 817 818 A large value of $\eta$ indicates a high degree of rational 819 consumption allocation, and vice versa. But if the value of $\eta$ 820 is too high, the amount of oil for contemporary human beings is 821 too small to meet the needs. So we may give an alert analysis and 822 management by choosing a suitable critical value of $\eta$, say 823 $\eta‘$. Having known the value of $\eta‘$, we can obtain the 824 optimal allocation in the n years of one generation. 825 826 827 \subsection{Modeling the Rational Consumption Allocation} 828 829 We hope that future oil demand will not undergo a sharp decline, 830 and expect oil to be allocated among generations fairly. 831 Meanwhile, we wish that the resource is utilized in the most 832 efficient way. 833 834 835 As is assumed, one generation consists of n years, and now we 836 model at the interval of $n$ years, i.e. one generation. Based on 837 the assumptions, we can construct the following optimization 838 model: 839 840 \[ 841 \max\sum^{n}_{i=1}c_{i}\times d_{i} 842 \] 843 844 \begin{equation} 845 s.t.=\left\{\begin{array}{ll} 846 \frac{r}{\sum_{i=1}^nd_i}\geq\eta‘\ 847 d_i\geq a\times d_{i-1},i=1,2,\cdots,n\ 848 d_i\geq 0,i=1,2,\cdots,n 849 \end{array}\right.\end{equation} 850 851 \begin{vardesc}{Where}$c_{i}$: the utilization rate of oil at year $i$; 852 853 $\eta‘$: the degree of rational consumption allocation of oil 854 between generations. 855 856 $d_{i}$: oil consumption at year $i$, and $d_{0}$ indicates oil 857 consumption at initial time. 858 859 $r$: the total remaining oil in the first year of one generation. 860 861 $\alpha$: a given percentage such that the oil consumption at a 862 given year must not be less than $\alpha$ times the consumption in 863 the previous year. And $\alpha$ is close to 1. 864 865 866 \end{vardesc} 867 868 The objective here is to obtain the maximum total utilization rate 869 of oil in n years. The first constraint condition assures a high 870 rate of rational oil allocation between generations, while 871 $d_{i}\geq \alpha\times d_{i-1},i=1,2,\cdots,n$ makes sure that 872 the oil consumption at year $i$ is not less than $\alpha$ times 873 the consumption at year $i-1(i=1,\ldots,n)$. The purpose is to 874 guarantee a smooth oil demand change. 875 876 877 When $\eta‘,c_{i},r,\alpha$ is given, we can obtain the optimal 878 consumption allocation of oil between $n$ years by solving the 879 linear programming (12). As for the estimation of $c_{i}$ here, we 880 believe that the utilization rate should increase as time passes 881 by, but is always smaller than 1, nevertheless. Thus,$c_{i}$ can 882 be regarded as in the following form: 883 884 885 \begin{equation} 886 c_{i}=1-a_{1}e^{a_{2}t} 887 \end{equation} 888 889 890 where $a_{1}$ and $a_{2}$ are constants and can be determined by 891 fitting historical data. 892 893 The result we get here may not increase in an exponential way. 894 After determining the annual consumption, we can adjust it to 895 include the factors such as economy, demography, politics and so 896 on, until it is optimal. 897 898 899 Next, we give an illustration to show the consumption under 900 optimal allocation after year 2004. For instance, we set 901 $\alpha=1$, $\eta‘=1.67$, $r=1.0\times 10^{12}$ and year 2004 to 902 be the base time, i.e.$d_{0}$ is the oil consumption at 2004. Thus 903 we can give the prediction of the oil consumption after 2005, 904 which is shown in the following figure. 905 906 \begin{figure}[!htb] \centering 907 \includegraphics[width=0.7\textwidth]{fig07.eps} 908 \caption{Oil Consumption Under Optimal Allocation} 909 \end{figure} 910 911 From the above figure, we can find that annual oil consumption 912 under optimal allocation is far less than that in an exponential 913 way. That is to say, the optimal consumption varies smoothly. But 914 in the late phase of the prediction, consumption fluctuates 915 sharply. This is due to the reason that we may have chosen an 916 inappropriate $\eta‘$-value. However, the choosing of 917 $\eta‘$-value is rather difficult because it should incorporate 918 many factors such as population, price, specific economic 919 environment, etc. Fortunately, the data at the prophase can 920 clearly reflect the trend of oil consumption. 921 922 \subsection{The Policy} 923 To guarantee a sufficient amount of oil for our offspring to 924 sustain their development, we must keep a rational allocation of 925 oil. This can be done through the following measurements: 926 927 \begin{enumerate} 928 \item We may levy a relatively heavy tax on oil compared with other resources. 929 \item We should encourage the development of alternatives for oil. 930 \end{enumerate} 931 932 ‘Security‘ Policy for Oil We believe that the problem of oil 933 security arises mainly due to the different utilization rates 934 among countries. For example, if a country with low oil 935 utilization rate is assigned a redundancy of oil, whereas a 936 country with high utilization rate is assigned an insufficient 937 amount of oil, this phenomenon will lead to a great waste. Based 938 on this idea, we can establish one model to find out the optimal 939 distribution of oil among the countries with different utilization 940 rates. 941 942 \subsection{Assumptions:} 943 \begin{enumerate} 944 \item The utilization rates among countries are different. 945 946 \item The low utilization rate is the primary source to result 947 in the misuse and waste of oil. 948 949 \item The annual oil consumption of the whole world is according 950 to optimal oil allocation model in Task 3 951 952 \item We do not take the trade barrier into account, and assume 953 that reallocation of oil between countries is feasible. 954 \end{enumerate} 955 956 957 \subsection{Modeling:} 958 Suppose there are $n$ main oil-consuming countries in the world. 959 Given the year $t$, we can establish the linear programming as 960 follows: 961 962 \[ 963 \max\sum^{n}_{i=1}l_{i}(t) \times x_{i}(t) 964 \] 965 966 \begin{equation} 967 s.t.\left\{\begin{array}{ll}\sum^{n}_{i=1}x_{i}(t)=d(t)\ 968 x_i(t)\geq\alpha_i(t)\times x_i(t-1),i=1,2,\cdots,n\ 969 x_i(t)\geq 0,i=1,2,\cdots,n \end{array}\right. 970 \end{equation} 971 972 973 \begin{vardesc}{Where}$l_{i}(t)$ : the oil utilization rate of country $i$ at year 974 $t$; 975 976 $x_{i}(t)$: the oil consumption of country $i$ at year $t$; 977 978 979 $d(t)$: the world-wide oil consumption allocation at year $t$, 980 which can be obtained using the model in Task 3. 981 982 $\alpha_{i}(t)$: the minimum ratio of $x_{i}(t)$ to 983 $x_{i}(t-1)$.in percentage. 984 \end{vardesc} 985 986 987 988 Remark: $\alpha_{i}(t)$, as a parameter, is close to 1, and it 989 needs to be evaluated according to the different situations and 990 the rationality of oil consumption of countries. 991 992 The first constraint condition means the sum of oil consumption of 993 different countries at year $t$ should equal total oil consumption 994 at year $t$ under optimal oil allocation. 995 996 The constraint condition $x_{i}(t) \geq \alpha_{i}(t) \times 997 x_{i}(t-1),i=1,2...,n$ means the oil consumption of country $i$ at 998 year $t$ is not less than a certain degree of the previous year‘s 999 consumption. This degree is different among countries. From this 1000 model, we can see that the country with higher oil utilization 1001 rate has relative privilege to get the oil supply. The optimal 1002 solution of the linear programming represents the optimal oil 1003 distribution among countries at year $t$. Thus, we can meet the 1004 needs of every country with the minimal waste of oil. 1005 1006 \subsection{Limitations of the model} 1007 The model we have designed above is for the sake of the interest 1008 of the entire world, but in reality, countries would more likely 1009 consider their own interests, leading to the result of tight trade 1010 barriers among countries, and consequently making it impossible to 1011 get the optimal distribution. 1012 1013 \subsection{Conclusion} 1014 For a country with large oil demand but low utilization rate, we 1015 should fulfill its consume level while cut down the extra oil 1016 demand, while for a country with small oil demand but high 1017 utilization rate, we should meet its demand to the maximum extent, 1018 in order to prevent oil waste. 1019 1020 \subsection{The Policy} 1021 To assure a good utilization of oil, and reduce unnecessary waste, 1022 we give the following measurements: 1023 1024 \begin{enumerate} 1025 1026 \item We may levy a relatively heavy tax on oil to countries with 1027 low utilization rate. 1028 1029 \item We can set a limit on the annual oil consumption for countries with low utilization rate 1030 \end{enumerate} 1031 1032 1033 \section{Task 5 Oil Exploitation vs. Natural Disasters} 1034 1035 Oil exploitation is a tough task because the nature is very 1036 vulnerable. And if our activities go against the intrinsic laws of 1037 nature, we will be punished by it. Oilfield occupies a large range 1038 of area, destroys the vegetation in the vicinity, changes the 1039 components of the soil, and deteriorates the environment near by, 1040 and hence the animals will lose their habitat. With the 1041 exploitation of the field, it will influence the groundwater and 1042 cause desertification. An obvious instance is oil spill, which 1043 often leads to the pollution of nearby water area, and further 1044 destroys the entire water area eco-system. 1045 1046 Next, we mainly consider the effects of oil exploitation on 1047 natural disasters. We hope that the susceptibilities to disasters 1048 to be as low as possible while the demand for oil is satisfied. 1049 1050 1051 \subsection{Assumptions} 1052 \begin{enumerate} 1053 \item The amount of oil exploited entirely turns into consumption. 1054 1055 \item The total amount of oil exploited can meet the need of 1056 economic development. 1057 \end{enumerate} 1058 1059 \subsection{Modeling the short-term effects} 1060 1061 We mainly consider the short-term effects, and assume that the 1062 total number of oilfields on the earth is $n$. According to the 1063 first assumption, oil exploitation is at the same level of oil 1064 consumption. In order to satisfy the sustainable development of 1065 the economy, we must try to keep the total output of all oilfields 1066 to be the same as the world-wide oil consumption under optimal 1067 allocation in Task 3. Thus, we have the following equation: 1068 1069 \begin{equation} 1070 \sum^{n}_{i=1}x_{i}(t)=d(t) 1071 \end{equation} 1072 1073 1074 \begin{vardesc}{Where}$x_{i}(t)$: the output of the ith oilfield at year $t$; 1075 1076 $d(t)$: the world wide oil consumption under optimal oil 1077 allocation in Task 3. 1078 \end{vardesc} 1079 1080 For a specific oilfield $i$,we believe that its susceptibility to 1081 disasters has something to do with its output at a given year and 1082 the ratio of its cumulative output to its initial oil reserve. 1083 1084 Naturally, the more the oil is exploited, the greater the 1085 likelihood of disasters will be. We believe that they are of 1086 linear independence. And of course, a new oilfield and an old one 1087 will have different effects on the environment. This difference is 1088 shown by the ratio of the cumulative output to the initial oil 1089 reserve. Here we introduce a penalty function 1090 $e^{-\alpha(1-\lambda_{i}(t))}$,and get the following equation: 1091 1092 \begin{equation} 1093 p_{i}(t)=k_{i}\times x_{i}(t)\times e^{-\alpha(1-\lambda_{i}(t))}, 1094 \end{equation} 1095 1096 \begin{vardesc}{Where}$k_{i}$: proportion coefficient, which is determined by the 1097 position and exploitation method of the oilfield. Here, a small 1098 value of $k_{i}$ represents a prior position and an advanced 1099 exploitation method. 1100 1101 $p_{i}$: the susceptibility to disasters. 1102 1103 $\lambda_{i}(t)$: the ith oilfield‘s ratio of its cumulative 1104 output until year $t$ to its initial oil reserve. 1105 \end{vardesc} 1106 1107 We hope to minimize the total susceptibilities of different 1108 oilfields under the condition that the worldwide oil demands can 1109 be satisfied. That is: 1110 1111 \[ 1112 \min\sum^{n}_{i=1}p_{i}(t) 1113 \] 1114 \[ 1115 s.t.\sum^{n}_{i=1}x_{i}(t)=d(t) 1116 \] 1117 1118 The solution to this optimization problem generates the outputs of 1119 every oilfield that can assure the least possibility to disasters. 1120 Obviously, we find out those oilfields with small value of $k_{i}$ 1121 will have larger outputs and vice versa. 1122 1123 We also increase the value of $n$ tentatively, i.e. to increase 1124 the number of oilfields, and find that the total susceptibilities 1125 will decrease. This is mainly due to the fact that during the 1126 prophase of exploitation,$\exp^{-\alpha(1-\lambda_{i}(t))}$ plays 1127 an important role, leading to the exploitation of new oilfields, 1128 and this will decrease the likelihood of disasters. 1129 1130 1131 \subsection{The Policy} 1132 1133 Our policy is to increase the output of old oilfields with small 1134 $k_{i}$-value (those with a prior position and a priority of 1135 exploitation), and reduce the output of those with large 1136 $k_{i}$-value (those with an inferior position and a backward 1137 exploitation method). Also, if possible, we should exploit as many 1138 new oilfields as possible and decrease the exploitation of old 1139 oilfields, so as to control the susceptibilities to disaster. 1140 1141 \subsection{Long-term Effects} As for the long-term effects, for a 1142 given oilfield, the average annual output should be minimal. So it 1143 allows us to carry out an intensive exploitation in one year and 1144 then a mild one in another. By doing so, there is no necessity for 1145 us to increase the number of new oilfields in a short time, and 1146 the benefit is that it allows us to have enough time to search for 1147 and construct new oil fields. 1148 1149 1150 \section{Task 6 The Development of The Alternatives for Oil} 1151 1152 With the development of human, oil is being used ceaselessly. And 1153 we have estimated that if oil consumption increases in an 1154 exponential way, it will be used out in about thirty years. Even 1155 if we control the use of it, the time can only be prolonged by 1156 four to five years. So, at present stage, we urgently need an 1157 alternative for oil. For the sake of sustainable development, we 1158 must gradually accelerate the consumption of oil‘s alternative at 1159 the anaphase of the depletion of oil. The question is how should 1160 we apply the alternative in order to keep the economy stable 1161 during the transition period. 1162 1163 \subsection{Assumptions} 1164 1165 \begin{enumerate} 1166 \item We only consider one kind of alternative. 1167 \item Oil and its alternative have precisely the same function as energy resource . 1168 \item The criterion of the measurement of oil and its alternative is their contributions to GDP. 1169 \item We assume that the quantity of oil to produce unit of energy will not change as time elapses. 1170 \end{enumerate} 1171 1172 \subsection{Analysis} 1173 1174 We assume that the cost for oil to produce unit energy is $c_{1}$, 1175 and that of its alternative is $c_{2}$ m such that $c_{1}\leq 1176 c_{2}$. This is on the basis the fact that the cost for oil to 1177 produce unit energy is lowest compared with any other resources 1178 (See [5]). Because of this, the consumption of oil is far greater 1179 than those of its alternative. 1180 1181 But we must realize the fact that the total amount of remaining 1182 oil on the earth is declining, so the price of oil will 1183 correspondingly increase on the whole, leading to the rise of oil 1184 cost. On the other hand, with the advancement of the technology 1185 for the alternative, their prince will fall, and as a result makes 1186 a low cost possible. The general tendency can be found in the 1187 following figure: 1188 1189 \begin{figure}[!htb] \centering 1190 \includegraphics[width=0.6\textwidth]{fig08.eps} 1191 \caption{The Trend of Cost for Oil and Its Alternative to Produce 1192 unit of energy} 1193 \end{figure} 1194 1195 From the trend above we get the conclusion that with the rising of 1196 the cost for unit oil, the consumption of it will become less and 1197 less, but its unit alternative will have low cost, and then the 1198 demand of them will according increase, until the day when oil is 1199 completely replaced by them. Now, the question we are faced with 1200 is at what a speed should oil be replaced. 1201 1202 1203 \subsection{Modeling} 1204 1205 From the above model for optimal oil distribution between 1206 countries, we have obtained the conclusion that the growth of 1207 consumption in future years will increase slowly. Hence, what our 1208 research is interested in is the time when oil demand begins to 1209 decline, i.e. the transition time of oil and its alternative. 1210 1211 Let GDP value to be $G$, $x$ to be the consumption of oil, $y$ to 1212 be the consumption of the alternative, and $t$ to be time. We can 1213 see that $G$ is a function dependent on $x$ and $y$, so 1214 1215 \begin{equation} 1216 G=G(x,y) 1217 \end{equation} 1218 1219 1220 From (17), we have: 1221 1222 \begin{equation} 1223 \frac{d{G}}{d{t}}=\frac{\partial{G}}{\partial{x}}\times 1224 \frac{d{x}}{d{t}}+\frac{\partial{G}}{\partial{y}}\times 1225 \frac{d{y}}{d{t}} 1226 \end{equation} 1227 1228 During the anaphase of oil consumption, we want to keep it at a 1229 low level in order to assure a smooth transition. We think that an 1230 exponential decline will seem to be reasonable, so we let: 1231 1232 \begin{equation} 1233 x(t)=x(t_{0})\times e^{b\times (t-t_{0})}(t>t_{0},b<0) 1234 \end{equation} 1235 1236 then 1237 1238 \begin{equation} 1239 \frac{d{x}}{d{t}}=x(t_{0})\times b\times e^{b\times (t-t_{0})} 1240 \end{equation} 1241 1242 \begin{vardesc}{Where}$b$ :the decline rate of oil consumption; 1243 1244 $x(t)$ :oil consumption at year $t$. 1245 1246 $t_{0}$:the time when oil demand begins to decline. 1247 \end{vardesc} 1248 1249 Substitute (20) into (18),and then we get: 1250 1251 \begin{equation} 1252 \frac{d{y}}{d{t}}=\frac{\frac{d{G}}{d{t}}+x(t_{0})\times b\times 1253 e^{b\times (t-t_{0})}\times \frac{\partial{G}}{\partial{x}} 1254 }{\frac{\partial{G}}{\partial{y}}} 1255 \end{equation} 1256 1257 1258 $\frac{d{y}}{d{t}}$ denotes replacement rate, 1259 $\frac{\partial{G}}{\partial{x}}$ means the contribution rate of 1260 oil to GDP,and $\frac{\partial{G}}{\partial{y}}$ means the 1261 contribution rate of the alternative to GDP. After we have known 1262 the value of $b$, $t_{0}$, $\frac{d{G}}{d{t}}$, 1263 $\frac{\partial{G}}{\partial{x}}$ and 1264 $\frac{\partial{G}}{\partial{y}}$, the replacement ratio of the 1265 alternative --- $\frac{d{y}}{d{t}}$, can be calculated, and with 1266 the information of $\frac{d{y}}{d{t}}$, we can work out the 1267 consumption of the alternative which will guarantee a stable 1268 economy. This consumption works as a guidance when we exploit the 1269 alternative. Next, we choose the year 2010 as $t_{0}$ and then 1270 simulate to study the consumption of oil and the alternative. The 1271 result is shown in the following figure: 1272 1273 \begin{figure}[!htb] \centering 1274 \includegraphics[width=0.7\textwidth]{fig09.eps} 1275 \caption{The Curves of the Daily Consumption of Oil and Its 1276 Alternative During the Transition Time} 1277 \end{figure} 1278 1279 Thus, we can determine the quantity of the alternative to be 1280 exploited which will assure the sustainable development of the 1281 economy. 1282 1283 \subsection{Improvements of the Model} 1284 As for the case where more than one alternative is available, we 1285 can also solve the problem using the method above. But the degree 1286 of exploitation difficulty is involved. To this end, we‘ve 1287 searched for some information, and have drafted the following 1288 report. In this report, we‘ve specifically introduced some 1289 alternatives for oil, and hope this will pave the way for future 1290 work. 1291 1292 1293 \begin{center} 1294 \textbf{Alternative Energy and Potential Oil Substitutes} 1295 \end{center} 1296 1297 Oil, a kind of nonrenewable resource, will be used up in the near 1298 future. 1299 1300 As it is pointed by C.J. Campbell ----- " The coming oil crisis 1301 will be just that because the transition will not be easy, but I 1302 sometimes think that the world needs a change in direction in any 1303 case. From the ashes of the oil crisis may arise a better and more 1304 sustainable planet. It must at least become more sustainable as 1305 mankind lives out his allotted life span in the fossil record. 1306 Whether or not it is better depends on how well we manage the 1307 transition." 1308 1309 Transition to an entirely renewable sustainable energy resource 1310 economy with resulting changes in lifestyles is inevitable. Will 1311 it be done with intelligence and foresight or will it be done by 1312 harsh natural forces? This is one of the main challenges, which 1313 lie before us. 1314 1315 The crisis is imminent. Those who anticipate can do well from the 1316 economic and political discontinuity; those who react can survive; 1317 but those who continue to live in the past will suffer. And we 1318 don‘t have long to prepare. 1319 1320 In this report, alternative energy and related technologies will 1321 be talked about. 1322 1323 \textbf{Alternative energy:} 1324 1325 1326 Alternative energy refers to energy sources, which are not based 1327 on the burning of fossil fuels or the splitting of atoms. The 1328 renewed interest in this field of study comes from the undesirable 1329 effects of pollution (as witnessed today) both from burning fossil 1330 fuels and from nuclear waste byproducts. Fortunately there are 1331 many means of harnessing energy, which have less damaging impacts 1332 on our environment. Here are some possible alternatives: 1333 1334 \textbf{Solar energy:} 1335 1336 1337 Solar energy is one the most resourceful 1338 sources of energy for the future. One of the reasons for this is 1339 that the total energy we receive each year from the sun is around 1340 35,000 times the total energy used by man. However, about 1/3 of 1341 this energy is either absorbed by the outer atmosphere or 1342 reflected back into space (a process called albedo). 1343 1344 Using solar energy provide a ticket for the environmental lobby. 1345 Solar energy is presently being used on a smaller scale in 1346 furnaces for homes and to heat up swimming pools. On a larger 1347 scale use, solar energy could be used to run cars, power plants, 1348 and space ships. But the restrictions are: A huge number of solar 1349 panels, which are not cheap, and of course, less sun means less 1350 power, so it‘s not fit in countries where sunshine is not a 1351 constant. 1352 1353 \textbf{Wind power:} 1354 1355 1356 Wind power is another alternative energy source that could be used 1357 without producing by-products that are harmful to nature. And 1358 human have a long history of using wind power in the form of 1359 windmill. Like solar power, harnessing the wind is highly 1360 dependent upon weather and location. The average wind velocity of 1361 Earth is around 9 m/sec. And the power that could be produced when 1362 a windmill is facing the wind of 10 mi/hr. is around 50 watts. 1363 1364 \textbf{Geothermal energy:} 1365 1366 1367 Geothermal energy is an alternative energy source, although it is 1368 not resourceful enough to replace more than a minor amount of the 1369 future‘s energy needs. Geothermal energy is obtained from the 1370 internal heat of the planet and can be used to generate steam to 1371 run a steam turbine. This in turn generates electricity, which is 1372 a very useful form of energy. 1373 1374 Because of the costs required in upkeep and the shortage of 1375 potential sites, geothermal energy systems are more inefficient 1376 than other alternative energy sources. 1377 1378 1379 \textbf{Hydroelectricity:} 1380 1381 1382 Hydroelectricity comes from the damming of rivers and utilizing 1383 the potential energy stored in the water. As the water stored 1384 behind a dam is released at high pressure, its kinetic energy is 1385 transferred onto turbine blades and used to generate electricity. 1386 This system has enormous costs up front, but has relatively low 1387 maintenance costs and provides power quite cheaply. In the United 1388 States approximately 180,000 MW of hydroelectric power potential 1389 is available, and about a third of that is currently being 1390 harnessed. 1391 1392 \textbf{Tide:} 1393 1394 1395 Similar to the more conventional hydroelectric dams, the tidal 1396 process utilizes the natural motion of the tides to fill 1397 reservoirs, which are then slowly discharged through 1398 electricity-producing turbines. The former USSR produced 300 MW in 1399 its Lumkara plant using this method. 1400 1401 \textbf{Oil substitutes:} 1402 1403 Biodiesel is made entirely from vegetable oil, it does not contain 1404 any sulfur, aromatic hydrocarbons, metals or crude oil residues. 1405 The absence of sulfur means a reduction in the formation of acid 1406 rain by sulfate emissions which generate sulfuric acid in our 1407 atmosphere. The reduced sulfur in the blend will also decrease the 1408 levels of corrosive sulfuric acid accumulating in the engine 1409 crankcase oil over time. 1410 1411 The lack of toxic and carcinogenic aromatics (benzene, toluene and 1412 xylene) in Biodiesel means the fuel mixture combustion gases will 1413 have reduced impact on human health and the environment. The high 1414 cetane rating of Biodiesel (ranges from 49 to 62) is another 1415 measure of the additive‘s ability to improve combustion 1416 efficiency. Unlike other "clean fuels" such as compressed natural 1417 gas (CNG), Biodiesel and other biofuels are produced from 1418 renewable agricultural crops that assimilate carbon dioxide from 1419 the atmosphere to become plants and vegetable oil. The carbon 1420 dioxide released this year from burning vegetable oil Biodiesels, 1421 in effect, will be recaptured next year by crops growing in fields 1422 to produce more vegetable oil starting material. But unfortunately 1423 it haven‘t been putted into wide use. 1424 1425 1426 \textbf{Gas hydrate} is an ice-like crystalline solid, its 1427 building blocks consist of a gas molecule surrounded by a cage of 1428 water molecules. Thus, it is similar to ice, except that the 1429 crystalline structure is stabilized by the guest gas molecule 1430 within the cage of water molecules. Many gases have molecular 1431 sizes suitable to form hydrate, including such naturally occurring 1432 gases as carbon dioxide, hydrogen sulfide, and several 1433 low-carbon-number hydrocarbons, but most marine gas hydrates that 1434 have been analyzed are methane hydrates. They occur in the pore 1435 spaces of sediments, and may form cements, nodes or layers. 1436 \textbf{Gas Hydrate} is found in sub-oceanic sediments in the 1437 polar regions (shallow water) and in continental slope sediments 1438 (deep water), where pressure and temperature conditions combine to 1439 make it stable. 1440 1441 1442 \textbf{Gas hydrate is an important topic for study for three 1443 reasons:} 1444 1445 It contains a great volume of methane, which indicates a potential 1446 as a future energy resource 1447 1448 It may function as a source or sink for atmospheric methane, which 1449 may influence global climate 1450 1451 It can affect sediment strength, which can initiate landslides on 1452 the slope and rise 1453 1454 Other things may be used as a substitute of oil. For example, some 1455 countries confronted with the oil crisis use \textbf{ethanol} as a 1456 substitute of oil. Although these substitutes may provide a 1457 possible outlet to the oil crisis, whether they can solve the 1458 energy problem is really unknown. 1459 1460 1461 \textbf{Conclusion:} 1462 1463 1464 Considering the concurrent problems of population size and 1465 stabilization, the adjustment of economies and lifestyles, the 1466 challenge of conversion to alternative energy resources is clearly 1467 exigent and formidable. A realistic appraisal of the future 1468 encourages people to properly prepare for the coming events. Delay 1469 in dealing with the issues will surely result in unpleasant 1470 surprises. Let us get on with the task of moving orderly into the 1471 post-petroleum paradigm. 1472 1473 \newpage 1474 1475 \begin{thebibliography}{1} 1476 \bibitem{1} Data of world population \\http://www.cpirc.org 1477 \bibitem{2} Chris Nelder, Oil Crises Delay¨CA World Price Forecast,$2004$,\\http://www.betterworld.com 1478 \bibitem{3} Data of oil demand, supply, reserves, and emission of $\textrm{CO}_{2}$ \\http://www.eia.doe.gov 1479 \bibitem{4} C.J Campbell, The Coming Oil Crisis, Published by MULTI-SCIENCE PUBLISHING CO.LTD. 1480 1997 1481 \bibitem{5} Raymond Vernon, The Oil Crisis, Published by George J. McLeod Limited, Toronto 1482 \bibitem{6} Atmospheric $\textrm{CO}_{2}$ concentrations (ppmv),\1483 http://serc.carleton.edu/files/introgeo/interactive/examples/mlco2.doc 1484 \bibitem{7} http://www.cc.utah.edu 1485 \bibitem{8} Alternative resources \\http://curtrosengren.typepad.com 1486 \bibitem{9} Alternative resources \\http://www.hubbertpeak.com 1487 \bibitem{10} Alternative resources \\http://www.cytoculture.com 1488 \bibitem{11} Alternative resources \\http://www.epa.gov/ 1489 \bibitem{12} Gas Hydrate web sites, \\http://woodshole.er.usgs.gov/project-pages/hydrates/external.html 1490 1491 \end{thebibliography} 1492 1493 \end{document}

标签:des style blog http color io os ar for

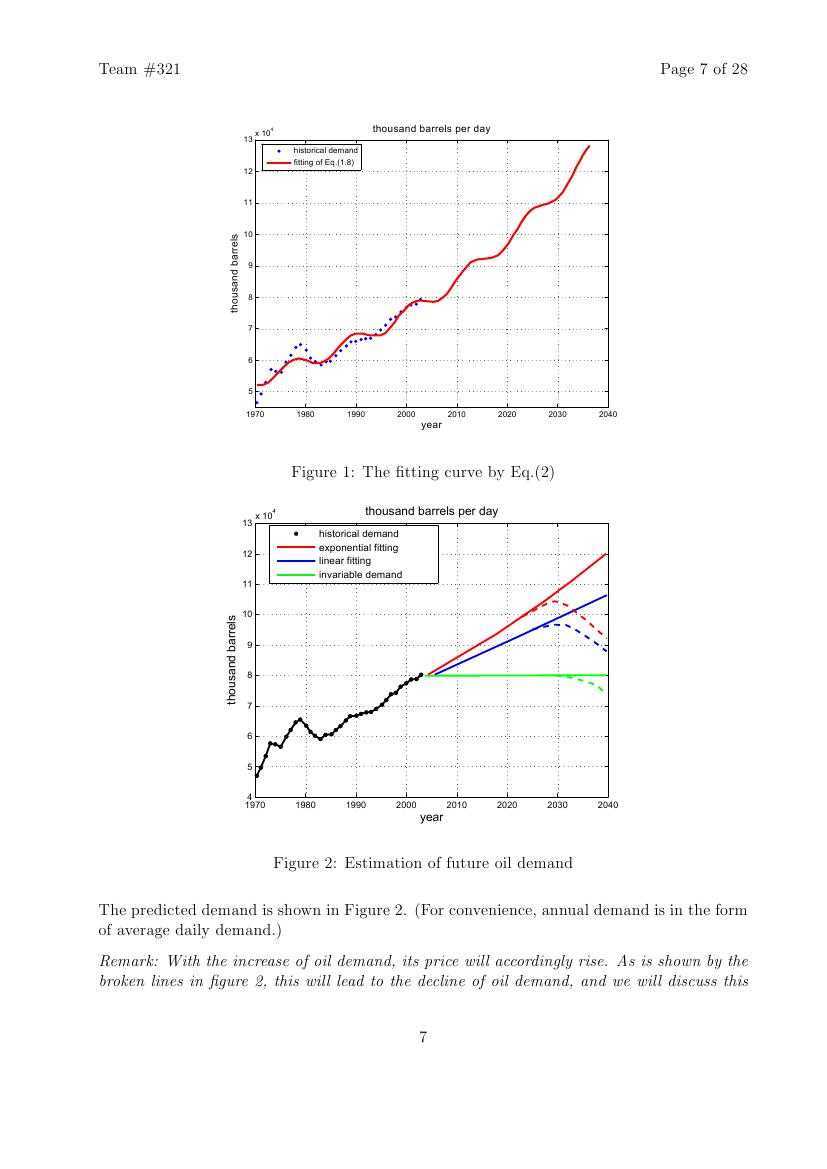

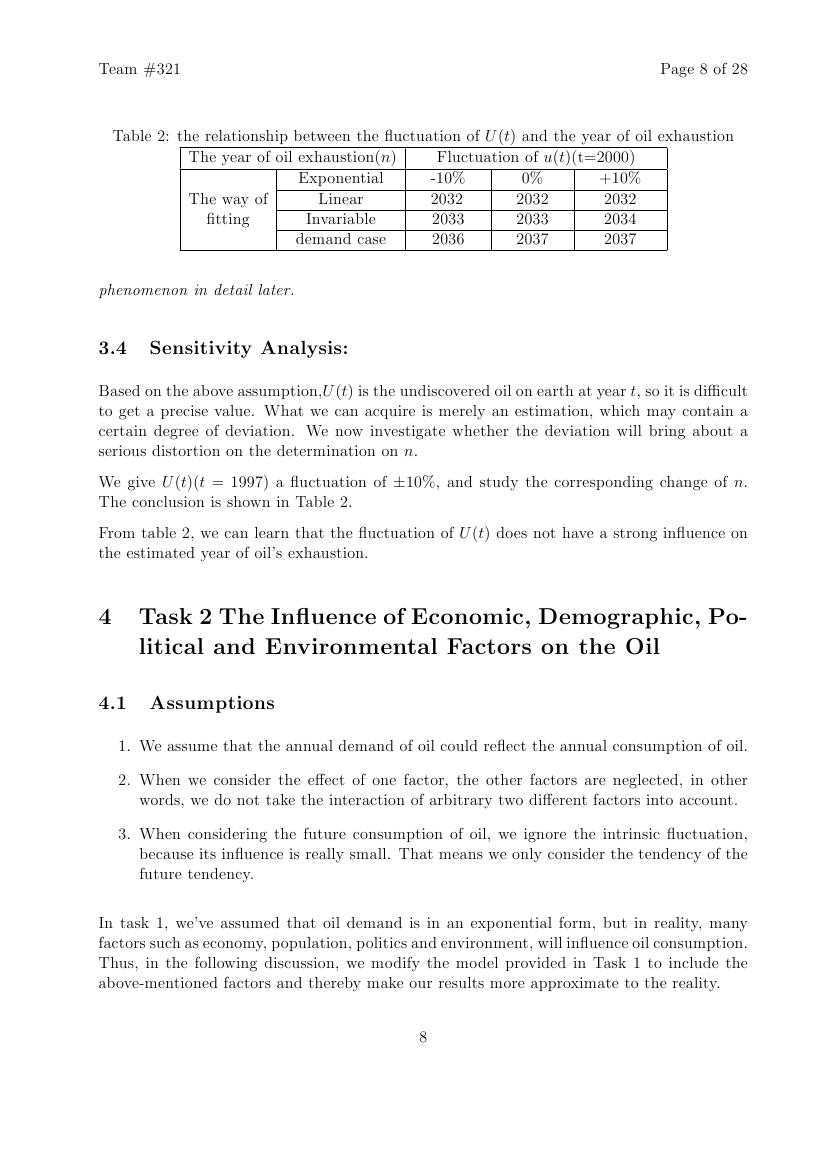

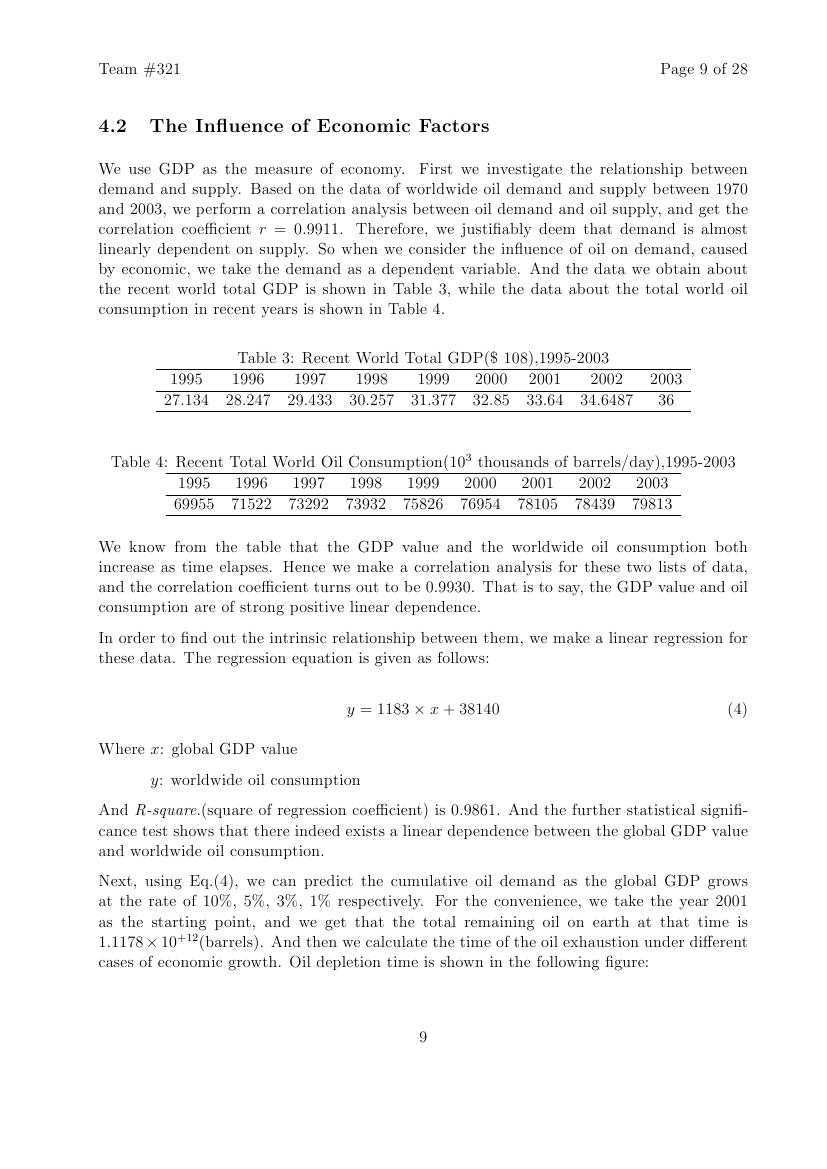

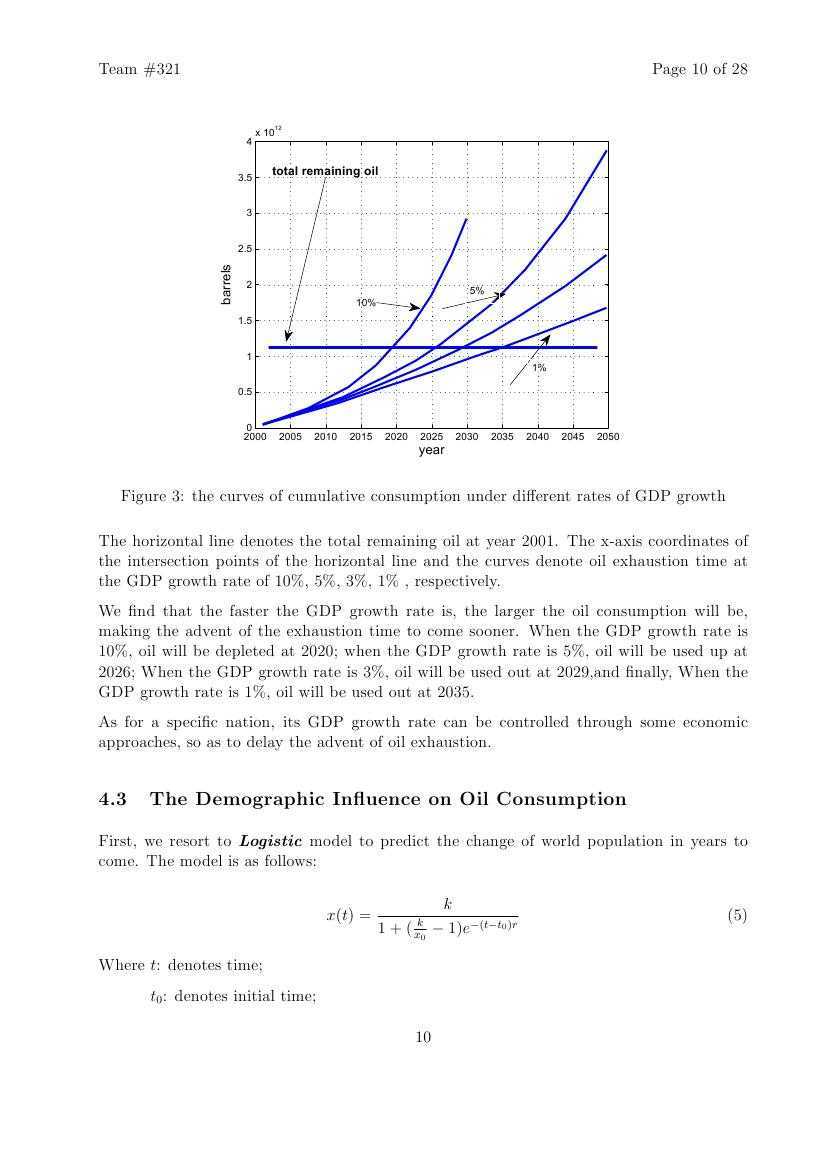

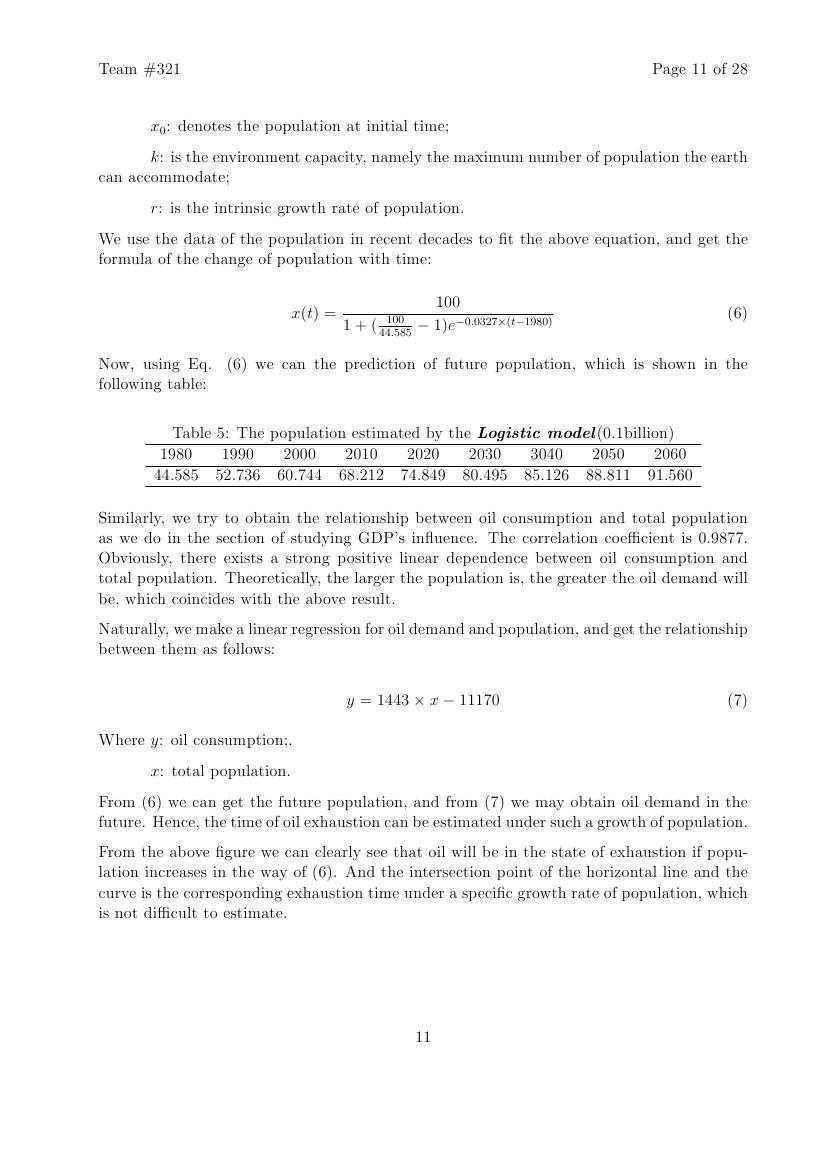

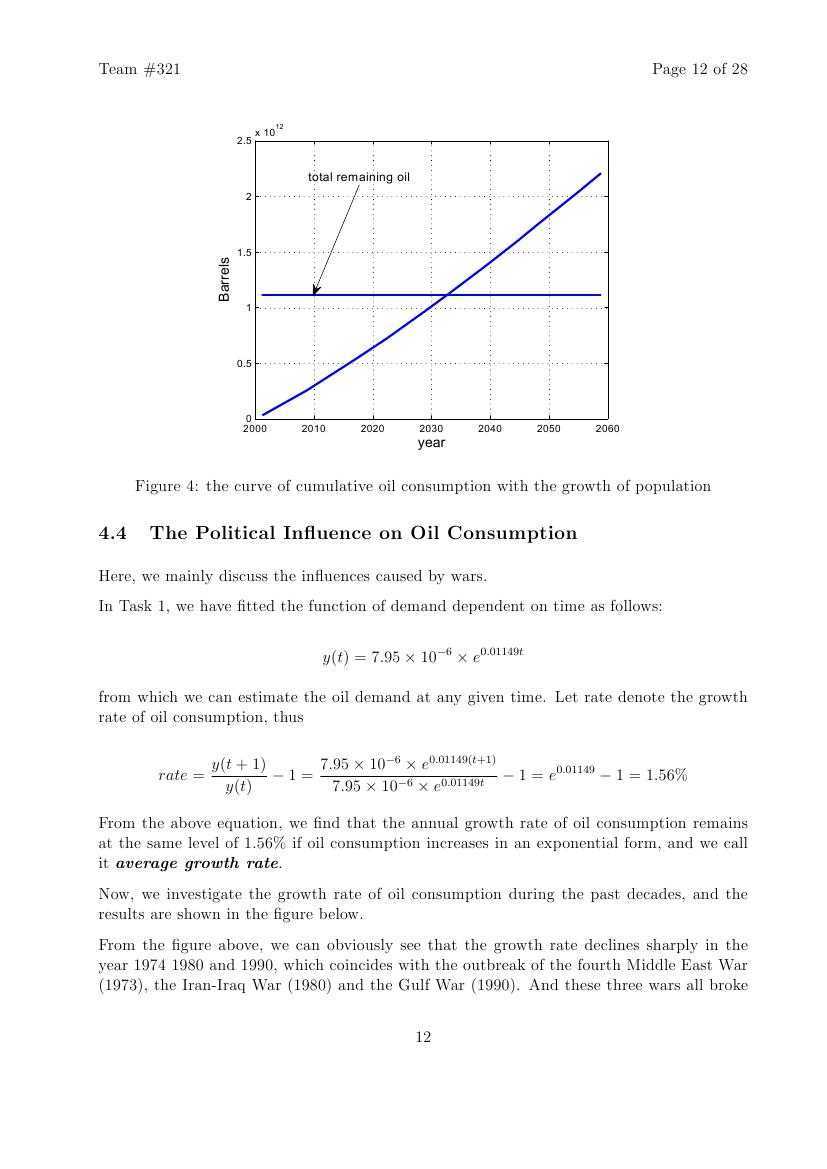

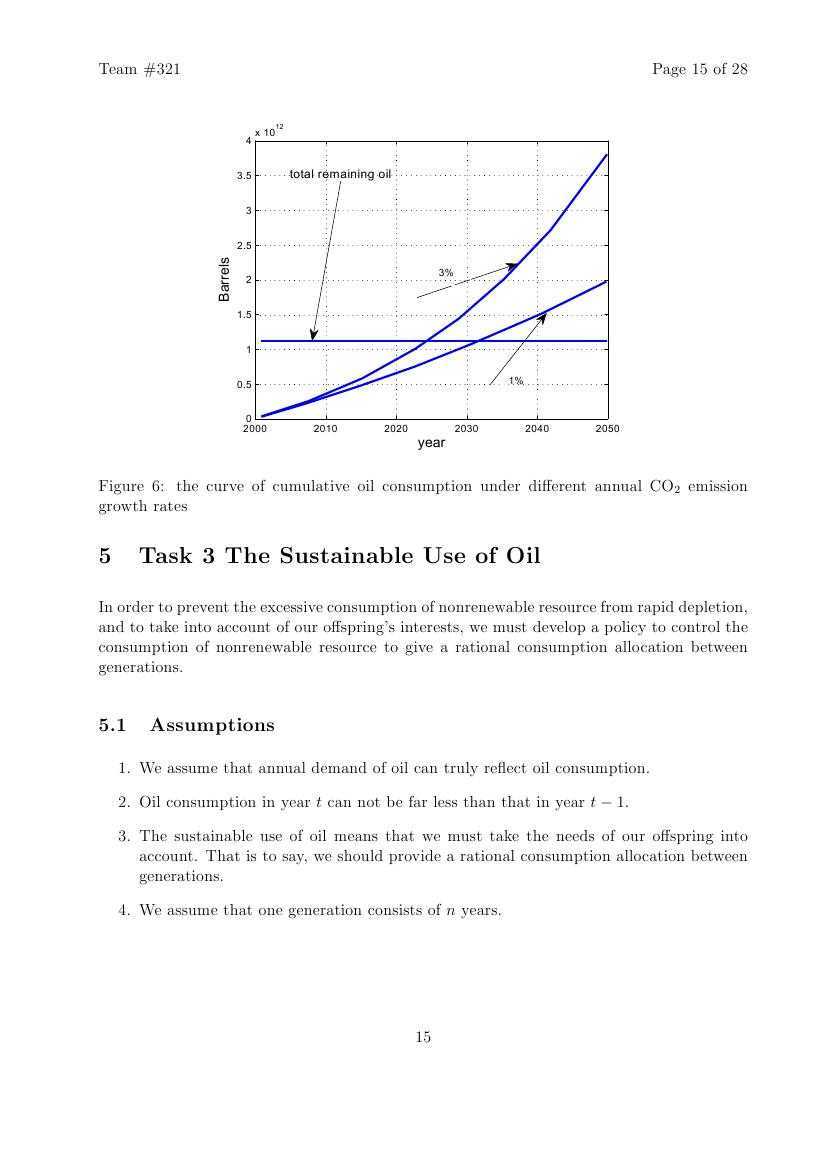

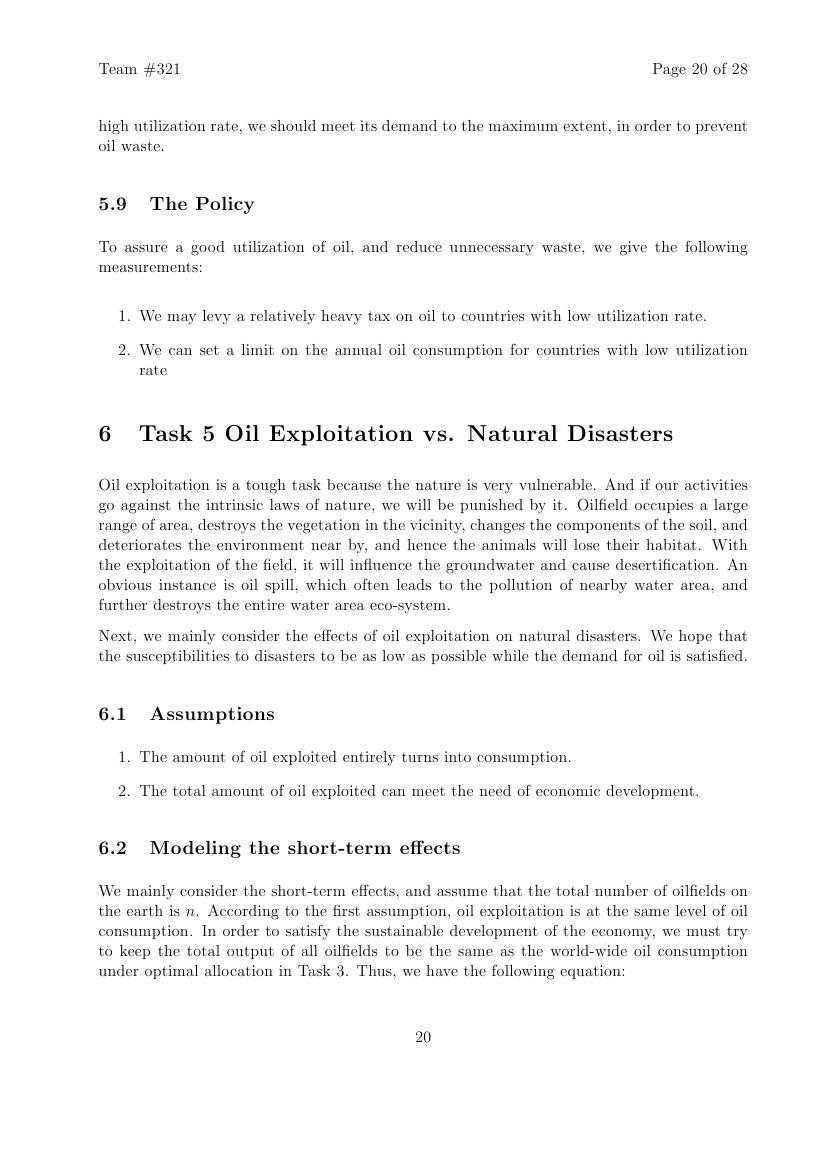

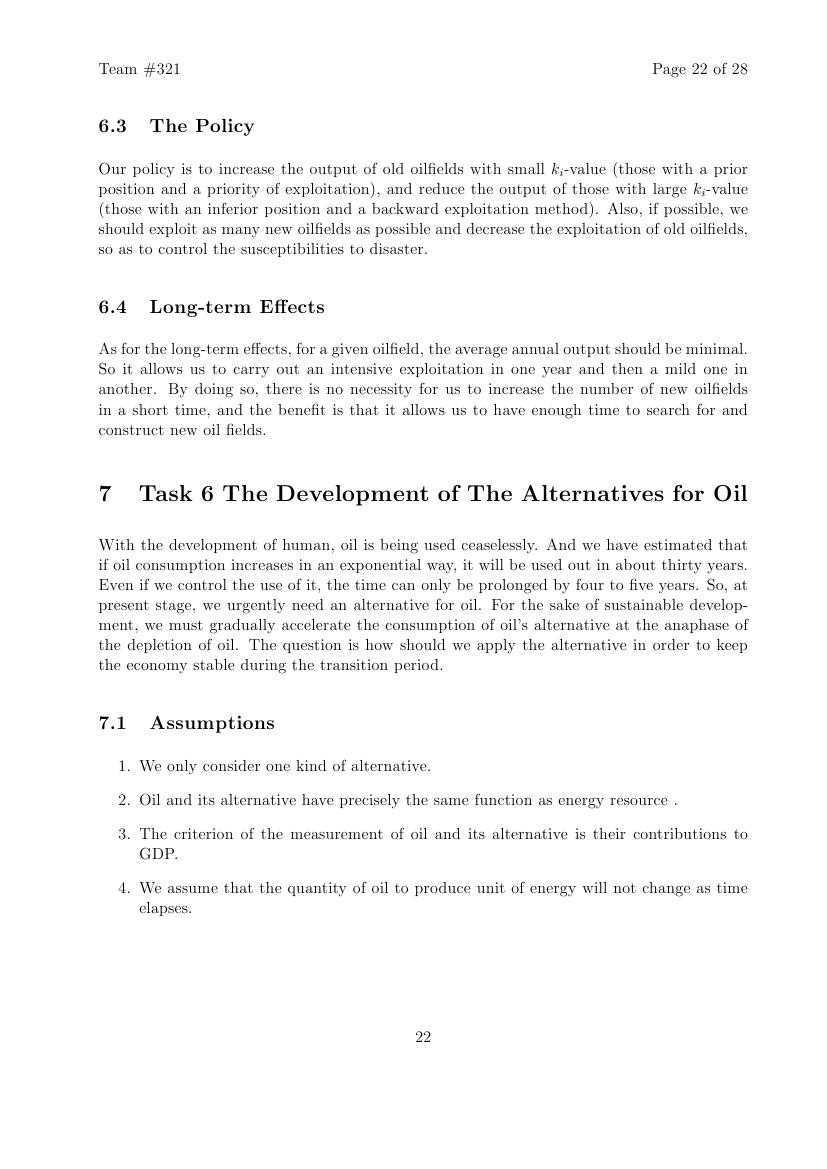

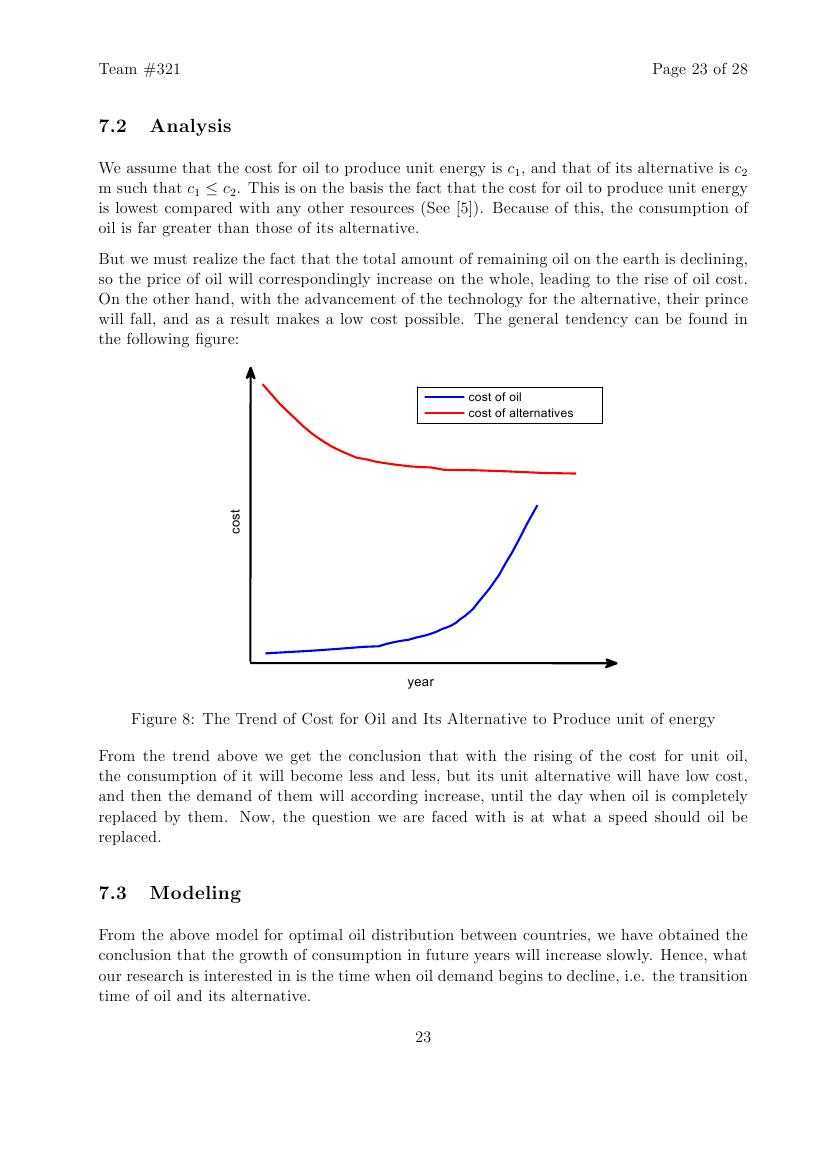

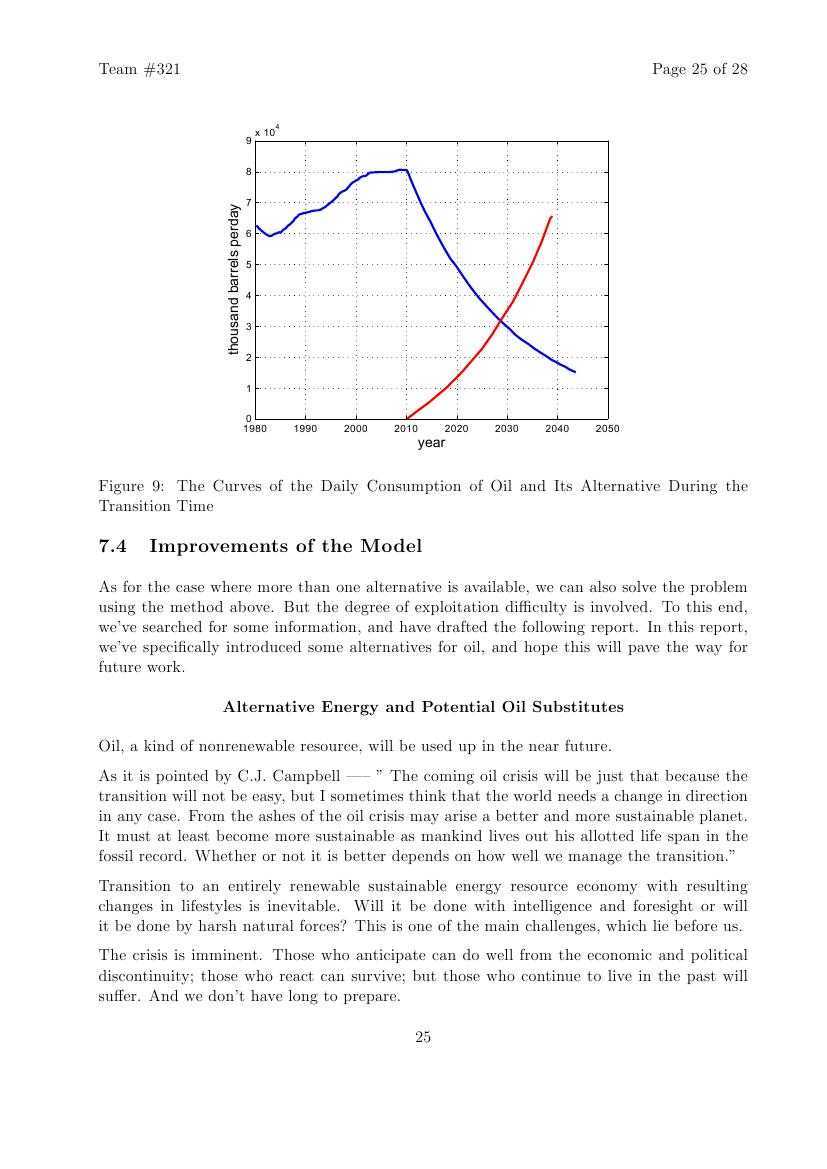

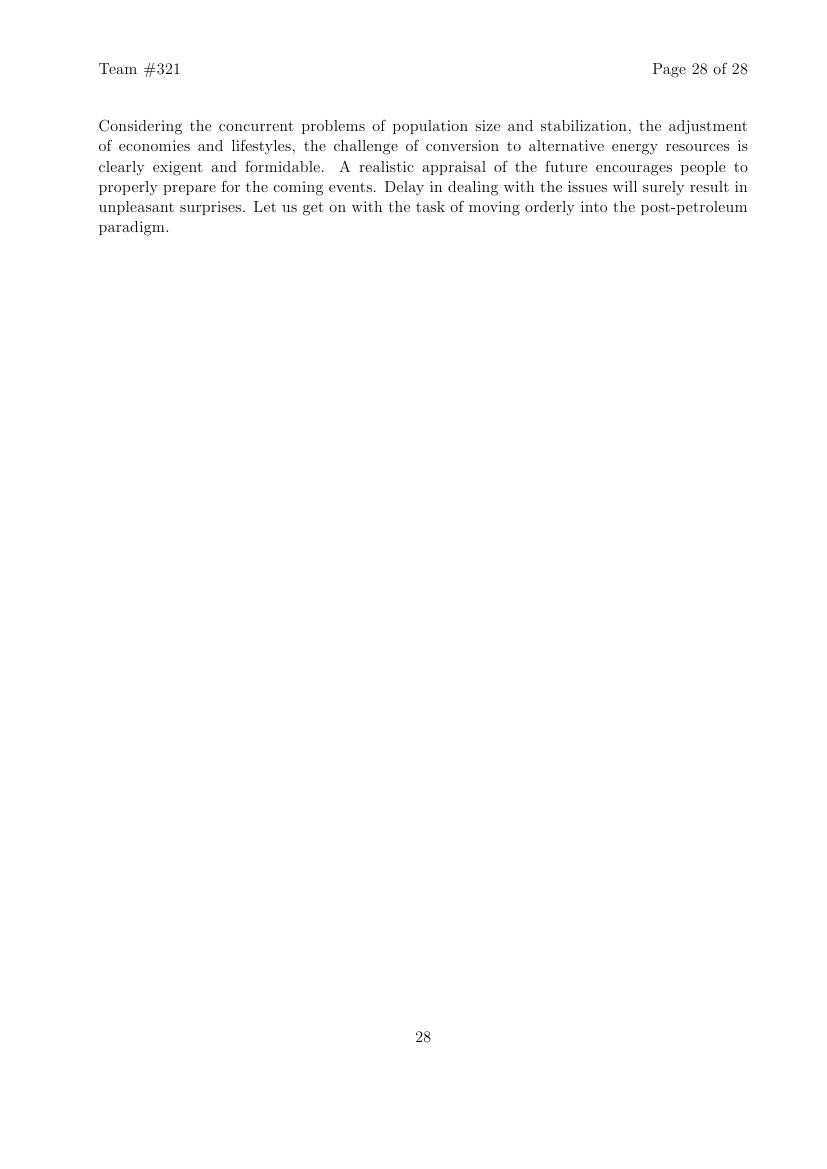

原文地址:http://www.cnblogs.com/jinliangjiuzhuang/p/4010435.html