标签:euler sam mic type comm zed mat rom run

*Catalog

1. Plotting Vasicek Trajectories

2. CKLS Method for Parameter Estimation (elaborated by GMM and Euler Approx)

3. Application

1. Plotting Vasicek Trajectories

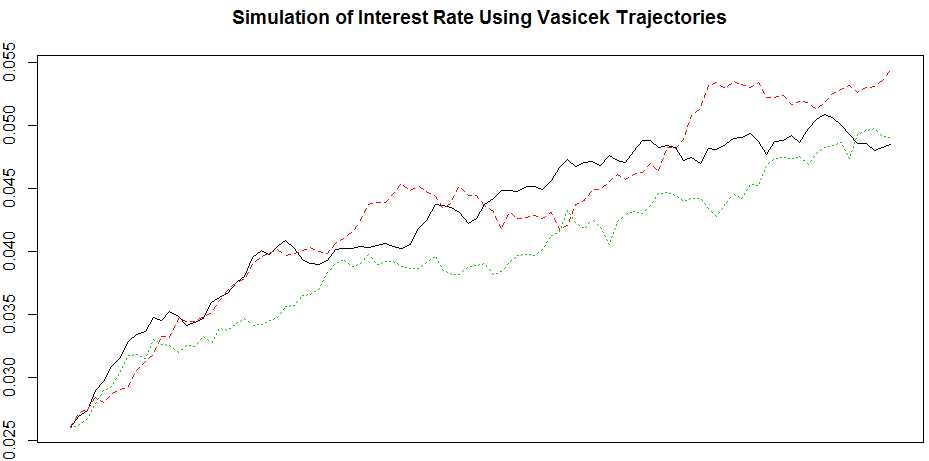

(1) Basic outlooking:

vasicek <- function(alpha, beta, sigma, n = 100, r0 = 0.026) {

v <- rep(0, n)

v[1] <- r0

for (i in 2:n) {

v[i] <- v[i - 1] + alpha * (beta - v[i - 1]) + sigma * rnorm(1)

}

return(v)

}

set.seed(13)

r <- replicate(3, vasicek(0.02, 0.056, 0.0006))

# plot columns of matrix against columns of another matrix

matplot(r, type = ‘l‘, ylab = ‘‘, xlab = ‘Time‘, xaxt = ‘no‘,

main = ‘Simulation of Interest Rate Using Vasicek Trajectories‘)

lines(c(-1, 101), c(0.056, 0.056), col = ‘grey‘, lwd = 2, lty = 1)

(2) Characteristics:

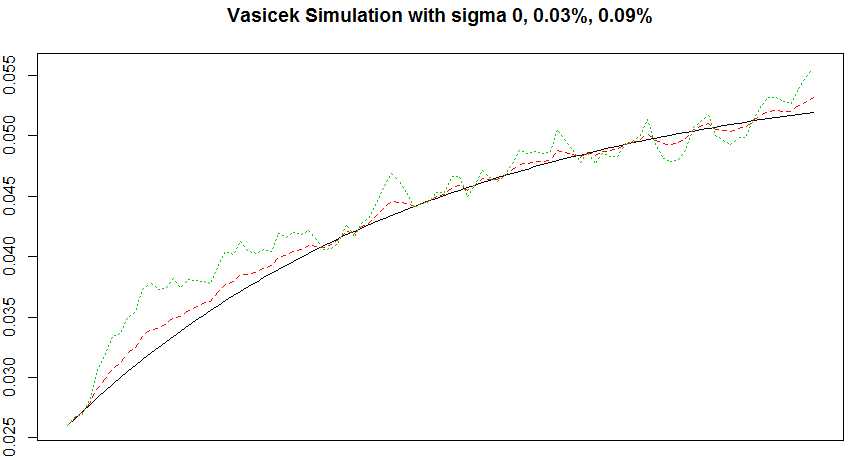

# change sigma (old sigma is 0.0006) r <- sapply(c(0, 0.0003, 0.0009), function(sigma){ set.seed(23); vasicek(0.02, 0.056, sigma) }) matplot(r, type = ‘l‘, ylab = ‘‘, xlab = ‘Time‘, xaxt = ‘no‘, main = ‘Vasicek Simulation with sigma 0, 0.03%, 0.09%‘)

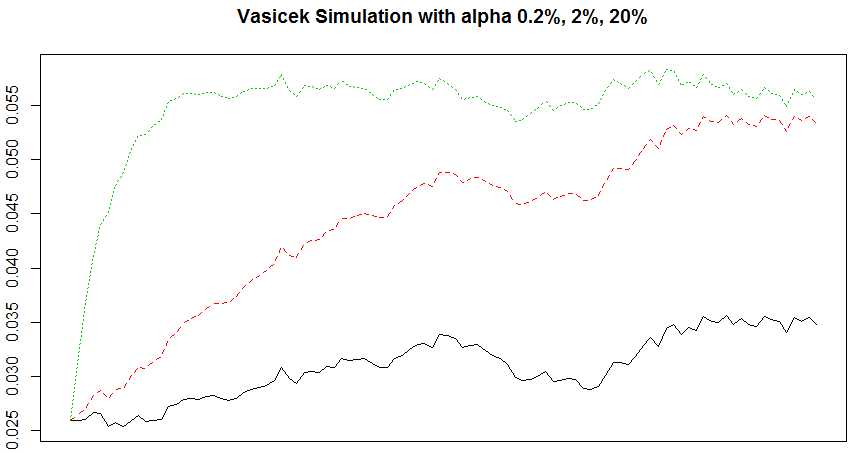

# change alpha (old alpha is 0.02) r <- sapply(c(0.002, 0.02, 0.2), function(alpha){ set.seed(33); vasicek(alpha, 0.056, 0.0006) }) matplot(r, type = ‘l‘, ylab = ‘‘, xlab = ‘Time‘, xaxt = ‘no‘, main = ‘Vasicek Simulation with alpha 0.2%, 2%, 20%‘)

(3) Comments:

This model is a continuous, affine and one-factor stochastic interest rate model.

It follows a mean-reverting process (expected value converges to beta when Time of alpha goes to infinity (alpha can be treated as speed of adjustment to the long-run beta). The higher alpha, the earlier reach long-term beta (which input by me as 0.056). As alpha goes infinity, variance converges to 0.

2. Parameter Estimation

(1) Generalized Method of Moments:

gamma = 0 in Vasicek model;

gamma = 0.5 in CIR model (which assumes that volatility term proportional to the square root of the interest rate level; and that interest rate has non-central

chi-squared distribution);

(2) Mechanism:

Denote a vector of parameters to be estimated, theta = (alpha, beta, sigma, gamma);

Set null hypothesis is : E[ Mt(theta) ] = 0;

Use a sample corresponding to E[ Mt(theta) ], which is denoted as mt(theta) = (1/n) * Σ Mt(theta), where t from 1 to n, and n is number of observations;

Introduce omega as a weight matrix, which is symmetric, positive and definite;

Thus, GMM minimize this quadratic term: mt(theta)Ω(theta)mt(theta);

3. Application

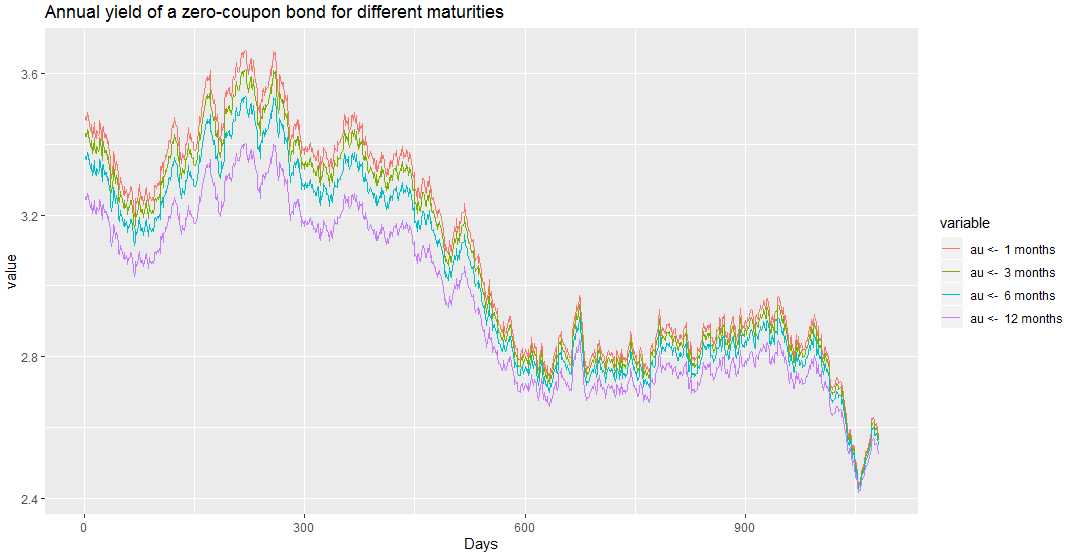

(1) Simulate bond prices with different maturities:

library(SMFI5) a <- bond.vasicek(alpha = 0.5, beta = 2.55, sigma = 0.365, q1 = 0.3, q2 = 0, r0 = 3.5, n = 1080, maturities = c(1/12, 3/12, 6/12, 1), days = 365) plot(a)

标签:euler sam mic type comm zed mat rom run

原文地址:https://www.cnblogs.com/sophhhie/p/12284577.html